Download the full article from Berenberg Capital Markets on the Nasdaq Private Market LinkedIn.

With startups waiting longer for IPO, private market liquidity is critical

While technology has allowed for significant improvements in the infrastructure underpinning the trading of equities and other liquid asset classes during the past few decades, such advances have been sorely lacking in the private markets. At a time when startup firms have been staying private for more than a decade on average, and when the aggregate value of pre-IPO company shares has swelled to ~$4trn, the processes that enable trading in the private markets remain primitive, and many of them could be fairly described as broken.

Seeking to leverage its proprietary technology to address the private market’s current shortcomings, and to position itself as the leading provider of solutions and services that enable institutional investors to confidently pursue opportunities in that space, is Nasdaq Private Market (NPM). Initially founded as a joint venture between SharesPost, Inc. and Nasdaq (NDAQ, Not Rated) in 2013, and subsequently acquired by Nasdaq to address the anticipated impact of the Jumpstart Our Business Startups (JOBS) Act on the U.S. corporate landscape, NPM has grown into an institutional-grade, regulated marketplace in which private companies and investors are able to engage in price discovery and find liquidity.

In 2021, NPM spun off from Nasdaq as an independent entity with investments from Nasdaq as well as a consortium of banks that includes Goldman Sachs (GS, Not Rated), Morgan Stanley (MS, Not Rated), Citigroup (C, Not Rated), and Allen & Company (Private). Since its launch, the marketplace has worked with private companies to create more than 625 liquidity programs ranging from tender offers, auctions, and block trades to company-directed windows of liquidity and pre-direct listing continuous trading. At the same time, NPM’s platform has facilitated ~$43bn in secondary liquidity for more than 160,000 employees and investors.

We spoke with NPM CEO Tom Callahan, and Brett Mock, the firm’s Head of Global Capital Markets, about the reasons why the efficient functioning of the private market is important, the areas in which NPM offers effective alternatives to the market’s status quo, and their efforts to position the marketplace to capture a large share of an untapped opportunity.

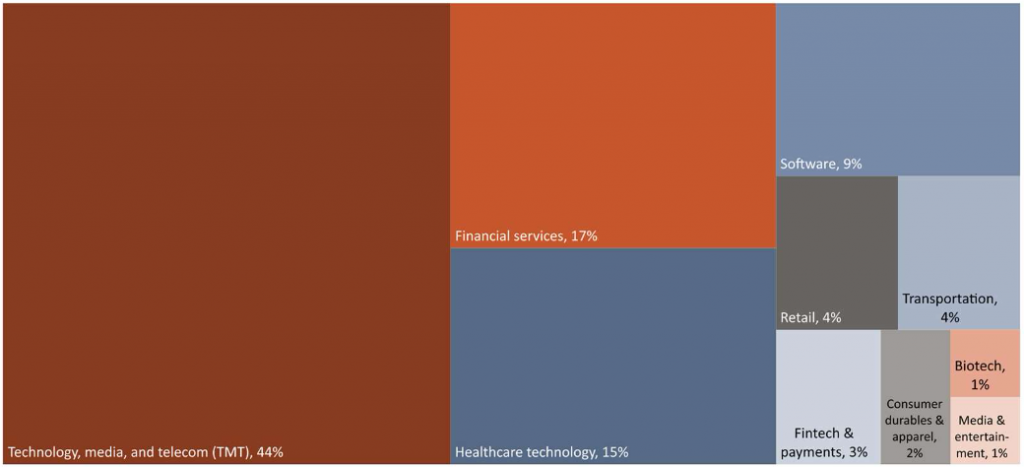

Source: NPM

Mr. Callahan, a 30-year finance industry veteran, joined NPM last year from BlackRock (BLK, Not Rated), where he led the transformation of the firm’s Global Cash Management platform, a $700bn business that provides liquidity and balance sheet solutions to many of the world’s public and private corporations. He described the private market as “the last great frontier of market structure,” which is dominated by boutique brokers and lacks the rules and automated processes seen in public markets.

NPM’s opportunity stems from its ability to bring order and efficiency to the chaotic but sizeable private market, Mr. Callahan said. He explained that the growth of the private market in the U.S. during the past decade can be traced to the JOBS Act that President Obama signed into law in 2012. The law was intended to give startup firms greater access to capital by easing many securities regulations, including an expansion of the number of investors and the amount of combined assets that a firm could have without having to file its financials with the SEC.

Flash forward to 2023, when private companies have been operating for a decade or more on average before going public. Mr. Callahan noted that such a length of time must seem like eons to young software engineers working for startups who would like to use a portion of the stock holdings they have received as compensation to pay off their student loans or buy homes.

Meanwhile, the increased availability of funding for startups in recent years, combined with the liberalized regulatory requirements for private firms ushered in by the JOBS Act, has given rise to a proliferation of “unicorns” – privately held startups valued at $1bn or more. While a couple of dozen startups met the definition of a unicorn in 2013, that figure has grown rapidly during the past decade and reached 721 in the U.S. this year, according to business information platform Crunchbase (Private). Fifteen years ago, many of these late-stage, venture capital-backed firms likely would have been mid-cap public companies by now.

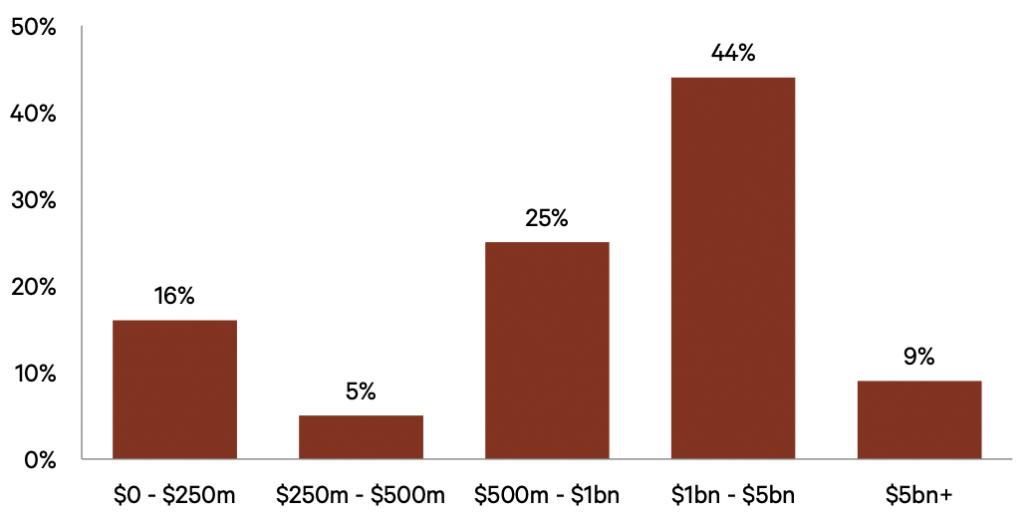

Source: NPM

Mr. Callahan noted that NPM has provided liquidity solutions to more than 180 unicorns. He noted that late-stage startups comprise the majority of the marketplace’s clients, a mix consistent with its focus on providing opportunities to institutional investors, who typically prefer to invest in companies with some heft. Institutions’ increasing appetite for private company stock is attributable in large part to the fact that, since the enactment of the JOBS Act, many companies are fully valued by the time they move to execute a public offering such that the opportunity to profit meaningfully by investing in them no longer exists.

Fixing private company stock settlement: no more “T plus whenever”

Other marketplaces seeking to create liquidity in the private markets have emerged in recent years. However, Mr. Callahan explained, most of the other firms operating marketplaces that facilitate trading of private company stock are focused on bringing opportunities to retail and high net worth investors rather than to institutional investors, as NPM does. “Frankly, no one else is in our space,” he said.

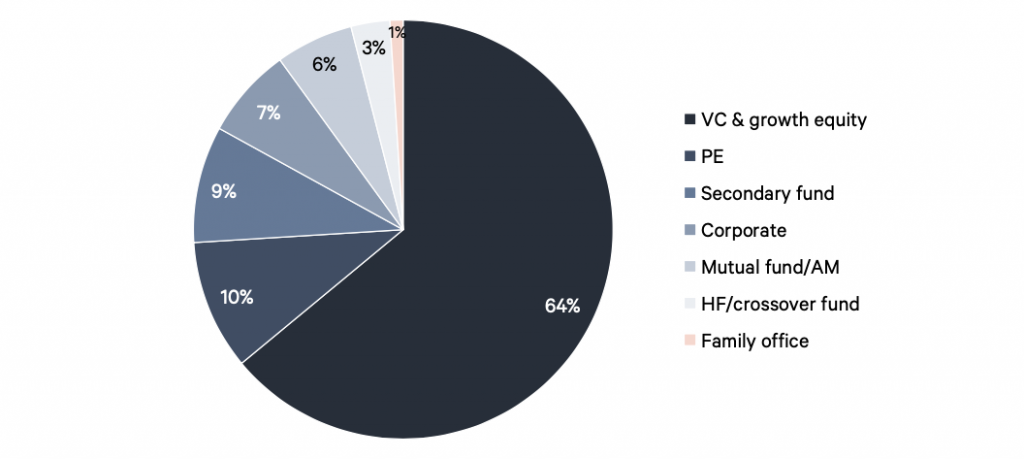

Source: NPM

While the length of time required for a trade to settle in the public equity markets is typically described as “T plus two,” – two days after the day on which an order is executed – Mr. Callahan noted that settlement times in the private market have been wryly described as “T plus whenever.” As excessively long settlement times have represented one of the biggest pain points deterring institutional investors from engaging with the private market, Mr. Callahan made the development by NPM of a market-leading solution to that problem one of his top priorities after he took its helm.

On April 26, NPM announced the launch of its Transfer and Settlement Solution (T&S), an open access service that, by applying automation to the process, allows for the settlement of private company stock transactions inside of a week in some cases, rather than the 90 to 120 days that has been typical in the space. In contrast to the disorganized and opaque process of settling trades that has been the norm in the private market, T&S offers a streamlined approach whereby stock transfer agreements (STAs) are stored and populated and stock transfer notices (STNs) are centralized, with users able to track transfer activity in real time through easy-to-use dashboards.

One of NPM’s goals is to establish T&S as the transfer agent for the entire private market, Mr. Callahan said. He noted that reliable settlement serves as the foundation of every asset class, and that by offering a dependable solution, NPM has set the stage for large, sophisticated investment firms to trade confidently in the private market.

Mr. Callahan noted that NPM is seeking to address another prerequisite for greater institutional adoption of the private market: access to data about the private firms whose stock is offered on its marketplace. As private companies face virtually none of the financial disclosure requirements with which public companies must comply, such data is very difficult to source. As such, Mr. Callahan explained, a significant information asymmetry has emerged in the private market, with a relatively small number of venture capital firms possessing the ability to compile private company data, and almost everyone else lacking the information they would need to make informed decisions about pre-IPO companies.

Late last December, NPM significantly enhanced its ability to provide investors with data they can use to analyze, value, and invest in private companies when it acquired a license to the private company database of valuation consultant, VC Experts (Private). The database provides NPM with a decade of company and transaction data points on approximately 15,000 private companies at various stages of growth. The underlying data, sourced from nearly 125,000 federal and state filings, includes financing details, share prices, board profiles, and other information that investors need to invest in the market for private company stock.

Promoting U.S. role as innovation leader by reforming private market

At the core of NPM’s platform is SecondMarket, its global trading marketplace for private companies. Leading the build-out of the marketplace during the past two years has been Mr. Mock, who brings nearly 30 years of experience in sales, trading, and capital formation to his role. He explained that NPM’s mission of bringing liquidity to the private market is part of a higher goal: helping to affirm the role of the U.S. as an incubator of innovation.

Mr. Mock observed that the U.S. economy has for decades distinguished itself from the economies of other countries by offering an environment in which entrepreneurs with innovative ideas are matched with investors willing to provide the funding they need to realize their visions. However, he said, the country’s ability to serve as the cradle for many of the world’s most innovative companies would be curtailed if the market through which employees and investors in private companies gain access to liquidity for their holdings were to remain dysfunctional.

NPM focuses on providing services and technology to its clients for which it charges a flat platform fee and a settlement fee, and it charges a select group of clients a fee for access to its data products, with plans to expand access to those products to all its clients over time. Mr. Callahan also noted that the marketplace’s adoption of a sponsored access model in partnership with some of the world’s most prominent financial institutions is instrumental to its core mission of establishing the infrastructure for the private market ecosystem. It also helped to ensure that it is understood that NPM is aligned with its clients, such as banks, brokers, and other market participants, rather than in competition with them.

Mr. Mock noted that as the markets continue to unfreeze, private market participants may look to secondaries as new sources of critical capital. NPM hopes to play a leading role in igniting and strengthening the asset class globally, he said.