Part 5 in the Nasdaq Private Market series on private company secondary auctions.

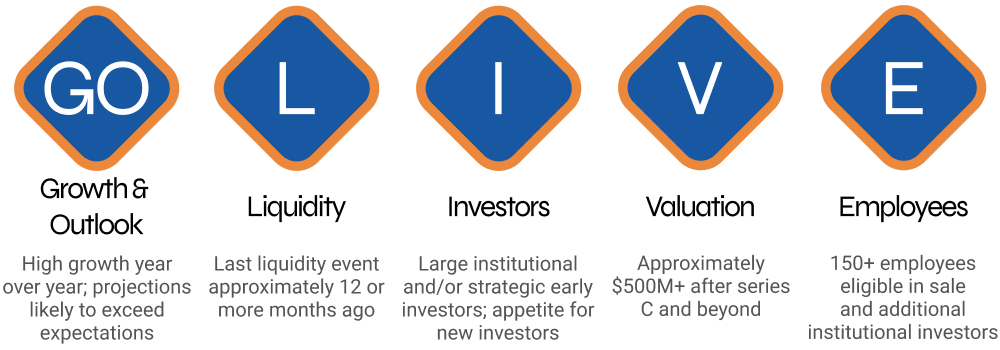

As a leading provider of liquidity solutions to private companies, Nasdaq Private Market (NPM) is frequently asked about the right way to structure a transaction and which transaction types will work best for a particular company. The answer is there are many factors that determine the best structure for your transaction. Our high-touch approach with clients and decade of experience helps us advise clients on how to best structure a program or transaction. Our business expertise and knowledge are additive to every transaction we work on together with clients. One framework that we utilize to identify companies eligible to conduct an auction or price discovery process is our “GO-LIVE” framework (see Figure 1 below).

NPM Go Live Framework

This framework provides the ideal benchmark for companies that may benefit from running an auction. However, the numbers and guidelines alone are not the only determinant factors that lead to a successful transaction.

The main factor that determines the success of an auction is the demand (both on the sell side and buy side). While we recognize that the sell-side demand is incredibly hard to project, buy-side demand can be slightly easier to predict. Generally, companies with high growth that have exceeded projections and continue to receive a great deal of interest from outside investors receive the most competitive bids during an auction. These companies are expecting continued growth and provide attractive investment opportunities for growth equity firms. Since growth is a strong driver of valuation, valuation is also an important factor for creating strong buy-side demand. Valuation provides an absolute benchmark for investors, in terms of fiat currency, and can be used in a number of investment criteria. With those factors in place, it is important to note that the most knowledgeable investors can be existing investors in the company. Existing investors often provide the most attractive bids due to their relationships with company leadership and understanding of the company’s operations, financial health, and future outlook. This can give them a leg up over outside investors in the bidding process. However, eager outside investors who are willing to take on the diligence may provide additional upward pressure on the bids. Investors who may not have been able to participate in the latest primary round often serve as some of the best bidders in a secondary auction (or any secondary transaction, for that matter). This may not be the case for all companies, though. If the company’s main business is relatively complex or the market is very niche, there may only be a small number of bidders who have the knowledge and ability to perform the necessary time-consuming diligence to make a viable bid1.

One way to help investors make more competitive bids is for the company’s management to hold meetings with investors to answer outstanding questions not answered by the disclosure materials provided at the beginning of every transaction. These meetings/calls consolidate investors’ questions and provide a channel to answer any outstanding inquiries. Another way to expedite the process is to use standardized agreements and documentation so investors do not have to spend time drafting an offer to purchase or transfer agreements. With investors putting in the work to place competitive bids and gather capital, it is important for the company to aggregate sell-side demand and educate eligible sellers about the process. Successful secondary transactions often have a “back-stop” in place to minimize the risk of undersubscription (selling fewer shares than what investors have bid for or what the company has forecasted to sell). We have seen a wide variety of methods for this back-stop including early investors, founders, or former employees who may have higher sellable limits to fill those bids not met by existing employees.

An auction can provide a centralized format for buyers to enter competitive, market-driven bids, while creating a transparent, beneficial path for sellers to receive fair prices for their equity. Combined with a proven software platform and an operational team with more than 625+ transactions worth of experience, NPM can help companies provide liquidity in a manner that potentially brings the private markets more value. Regardless of a private company’s liquidity needs, the auction format has several advantages over the traditional tender offer structure. NPM can engage with companies early on in the process to help avoid common pitfalls and maximize the likelihood of a successful auction.