Tender Offers + Repurchases

Create custom corporate-sponsored liquidity programs for employees, shareholders, and investors to sell and buy shares.

This Product Helps:

- Employees + Shareholders

- Private Companies

- Investors

Industry-Leading + Efficient

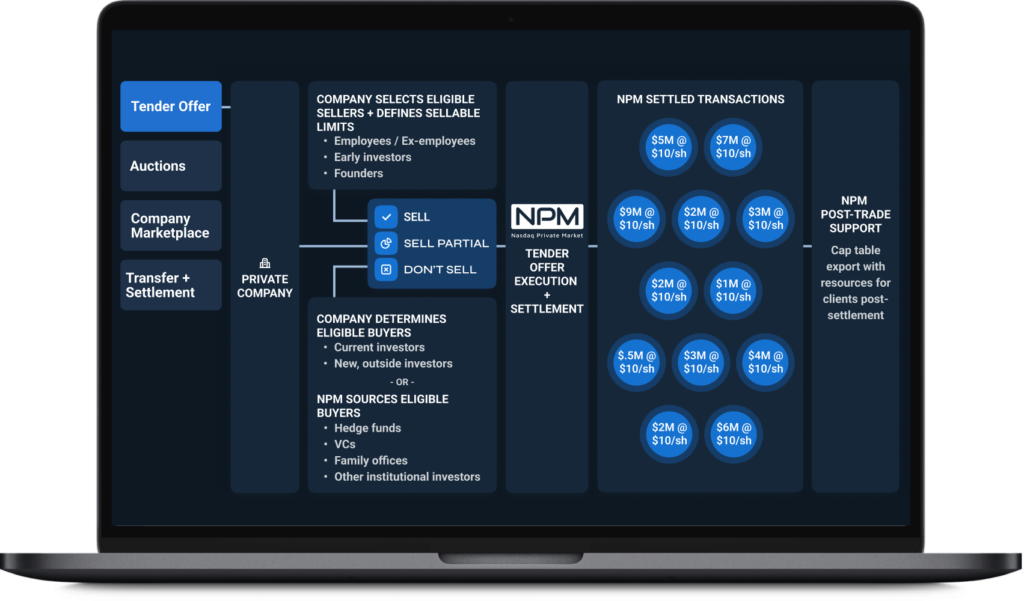

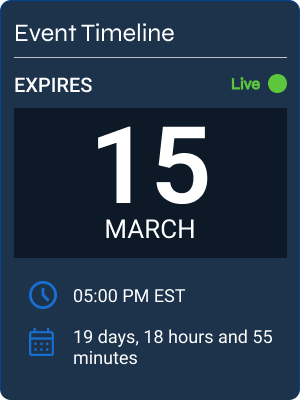

Our tender offer technology eases the operational burden on private companies and purchasers. Our platform streamlines the process of collecting participant interest, documentation, and signatures. Tender offer programs typically remain open for a minimum of 20 business days.

Address Shareholders’ Liquidity Needs Through Our Modern Secondary Technology

Tools to Address Shareholder Liquidity Needs

- Sophisticated Secondary Technology

- Compliant Trading Platform

- Network of Institutional Buyers

Program Participant Support From End to End

- Customized Onboarding Setup

- Guidance To Simplify Your Program

- Settlement to Expedite Cash Payment

Reward + Retain Employees

Convert Employee Shares to Cash

- An intuitive process for employees to sell their equity.

- Centralized platform to manage documentation.

- Self-service workstation to set share type and quantity.

- Automatic transfer of funds into seller accounts.

- Client success team for questions and assistance.

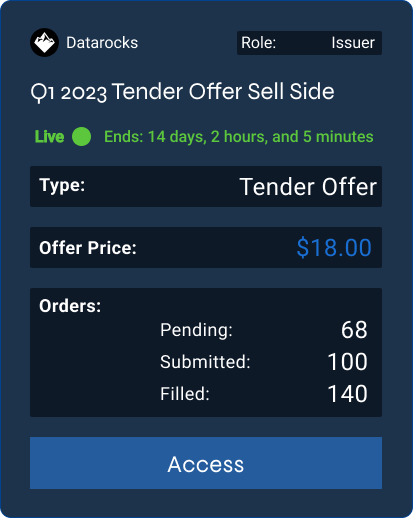

- Monitoring tools to track tender offer progress.

Build a Strong Company Culture

- Reward an employee-owner mentality.

- Align employee interests with the company’s.

- Incentivize growth by unlocking employee liquidity.

- Enhance company loyalty + reduce turnover.

- Attract top talent with actionable equity plans.

- Compete with public company employee equity.

A Private Market Pioneer with A Decade of Experience.

Industry-Leading Expertise

NPM has completed over $50B in transactional volume across more than 700 company programs.

Customized Platform Environment

Our customizable platform provides a flexible, end-to-end solution for your company to manage all of your liquidity needs.

Easy-to-Use Technology

Our intuitive platform simplifies the complexities of managing liquidity programs and is straightforward to configure to your specific company requirements.

Access to Leading Investors

The NPM investor network is available for companies that want to supplement their existing institutional investors with new capital introductions.

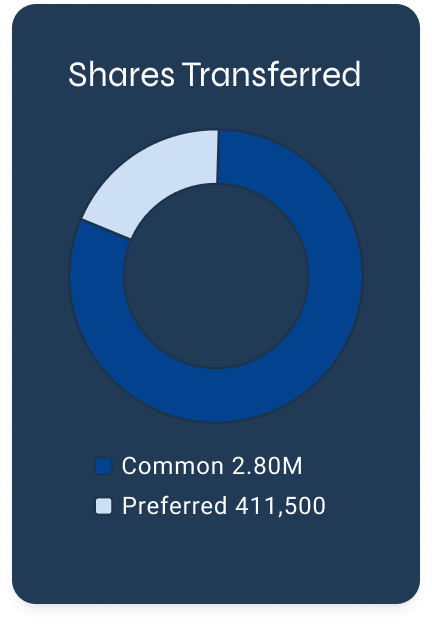

Cap Table Transfer

Professional expertise to fast track shareholder cap table data import / export before and after liquidity programs.

Greater Efficiency + Enhanced Execution

Our platform ensures companies execute without friction and stay in control of transfers through sophisticated dashboards and workflow tools from start through settlement.

A Streamlined + Simplified Process

Setup Tender Offer Program ↓

- Configure tender offer platform to your company’s parameters

- Upload company-approved disclosures to data room

- Map materials and holdings to the seller workflow

Launch Tender Offer ↓

- Host employee shareholder informational session and demo

- Provide real-time monitoring and trading activity reports for your company and shareholders

- Collect sell interest, legal documents, and agreements

Facilitate Payment + Settlement ↓

- Deliver report of securities offered in the program for your company to review and approve

- Wire funds to settle and pay exercise costs, withholdings, and net proceeds to your company and sellers

- Deliver final documents to your company and participants

Tax Tools ↓

- Auto generate Form 1099-B for tax reporting

- Referrals to tax advisors prior to participating in a tender offer

- High-touch client support for post-transaction tax considerations

How to Structure a Liquidity Program

In our conversations with founders, C-suite executives, investors, and advisors, we continue to hear many of the same questions.

When should we offer liquidity? How do we offer liquidity? What should we consider when structuring a program?