For employees of private companies, owning company stock as a part of their compensation package offers individuals an opportunity to act like owners with a vested interest in the success of the business. As private companies are staying private longer, increasingly employees are looking to sell a portion of their shares to pay for life events and expenses. Selling shares in a secondary transaction, where shares are traded between individual buyers and sellers is one way to achieve liquidity. However, selling shares can be a complex process for people unfamiliar with the secondary marketplace. Nasdaq Private Market offers an industry-leading, trusted secondary trading platform to connect buyers and sellers. Learn more about the intricacies of selling private company stock and explore the practical and financial considerations that employees must navigate to convert shares to cash.

Selling Private Company Stocks 101

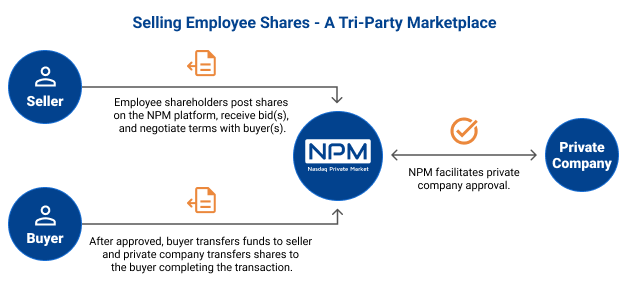

With many private companies staying private for a decade or longer, employers are recognizing the need to allow employees to sell their shares. The private secondary market is unique because it is a tri-party market between companies, buyers, and sellers. The process for selling private company shares is different than selling public stocks. One of the primary limitations is the lack of information and limited visibility into company financials, share price, and the demand for shares. Private company stock is not listed on an open exchange, and there is not a standardized system for pricing or trading. As a result, employees often struggle to find potential buyers or the fair market value for their shares on their own.

Additionally, shareholders are typically bound by strict agreements that impose restrictions about who can buy and sell shares and under what conditions. Companies and lead investors reserve the right of first refusal (ROFR), which can mean vetting processes for potential buyers, and in some cases legal fees associated with transferring share ownership. These factors can deter employees from selling their shares, complicate the transaction process, and delay access to needed funds. Often employees do not know where to turn and who to trust to get started. As a private market pioneer with a decade of experience, Nasdaq Private Market is a seasoned market operator with a team that understands how to navigate the selling process seamlessly for employee shareholders.

Liquidity + Speed

Unlike publicly traded stock, which can be sold relatively quickly, private shares cannot be converted to cash as quickly. Sometimes, the inherent illiquidity of private shares can affect the value, with potential buyers requesting a discount to compensate for the additional risk and difficulty in reselling the stock. This situation can force employees to sell their shares for less than they are potentially worth, just to meet their immediate cash needs. Nasdaq Private Market’s platform provides sellers with access to a vast network of buyers, the ability to post offers and react to bids, as well as full visibility into the settlement process.

Posting Shares

At Nasdaq Private Market, shareholders can initiate the process of selling their shares by contacting our sales team here and submitting a sell indication of interest. An indication of interest is a notification specifying the details of the shares a shareholder is interested in selling with us. This includes the type of shares (options, common or preferred), the quantity, and desired selling price. This crucial step serves as an official entry into the market, signaling to potential buyers the intent to sell. Once submitted, Nasdaq Private Market shares this information with our network of institutional investors, efficiently helping a client sell shares and match with potential, interested buyers. In our platform, sellers have the ability to receive bids for shares and negotiate with buyers. Then, our team settles the transaction and manages the transfer of shares adhering to all of the company’s share transfer requirements. After a trade is executed, funds are wired to the client’s account, and tax documentation is delivered to shareholder’s designated email address on file.

The Bid-Ask Spread

When selling private company shares, the bid-ask spread—the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept—can vary. Lack of financial disclosure requirements and market visibility can contribute to the bid-ask being wide. Sellers might have an inflated perception of the value of their shares based on internal metrics, future growth expectations, or an exciting brand, while buyers, aware of the liquidity risks and potential for future dilution, might be cautious and offer a lower price. This often complicates finding a middle ground in terms of price to sell shares.

Company Restrictions Around Selling Shares

Companies often implement restrictions on the sale of shares to protect proprietary information, valuation, and maintain control over the company’s ownership and cap table. These restrictions are usually outlined in shareholder agreements or bylaws and can include clauses that restrict sales to outsiders without prior approval, or mandate that shares be offered to the company or existing shareholders first.

These provisions help ensure that strategic stakeholders continue to hold a considerable influence in the company’s future. For employees, these restrictions sometimes mean navigating a maze of rules and obtaining necessary approvals. The market specialists and advanced trading technology at Nasdaq Private Market are all designed with issuers needs in mind to help employee shareholders streamline this process and efficiently sell shares in cooperation with the company.

Tax Implications of Selling Shares

Selling private shares also carries tax implications. The specific impact depends on how long the shares have been held and the price at which they are sold compared to their original purchase price. Navigating these tax issues require careful planning to avoid unexpected liabilities. Employees need to be aware of these factors and should consult with tax professionals to manage potential liabilities effectively.

Transfer + Settlement

Transferring and settling private shares involves a series of structured steps between the company, buyer, and seller. Careful coordination is critical to ensure the transfer is compliant and that all parties have the official documentation post trade. Initially, both the buyer and seller sign a stock transfer notice (STN), detailing the transaction specifics such as quantity, share price, share class, and identification details including stock certificate ID and contact information for all parties. Notices are sent to each issuer’s stock administrator, triggering the right of first refusal (ROFR) process. If the issuer decides not to exercise the ROFR and it is waived, a transfer fee may be collected from the seller.

Then a stock transfer agreement (STA) is drafted. It must be signed by the buyer, seller, and issuer. A payment agent facilitates the wire transfer of funds, ensures the seller receives the funds, and oversees the transfer of the electronic share certificate(s) to the buyer. The issuer then updates its cap table, to reflect the new ownership of the shares. Some trading platforms and brokers do not offer settlement which leaves the buyer and seller responsible for finalizing trades. Nasdaq Private Market offers a patent-pending Transfer and Settlement platform that manages the end-to-end transfer and settlement of shares post-match on behalf of issuers and shareholders.

Private Share Sale Pitfalls – Fees and Commissions

Employees should do their homework and understand in advance the commissions they will pay to brokers to sell shares. Certain platforms charge extraordinarily high commission rates, often in the range of 5-8% per transaction. Employees work hard to earn equity, so it is important to negotiate a fair commission rate for execution. Also, understanding the fair market value of a security is essential but can be difficult to uncover in the private market. In the public market, regulations require a consolidated tape or record of transactions, so sellers always know the real-time price of executed trades. No such consolidated tape exists in the private markets, often leaving sellers at the mercy of their broker to understand fair market value. Sellers should also independently do basic research regarding recent qualified funding rounds for the company and secondary trade history to ensure the price they are selling represents fair market value for their shares.

Conclusion

Understanding the intricacies of the process for selling shares helps employees make more informed trading decisions. With the right approach and assistance through Nasdaq Private Market’s secondary trading platform, shareholders navigate the complex landscape of private stock sales successfully.

Disclaimer

Nasdaq Private Market, LLC is not (i) a registered exchange under the Securities Exchange Act of 1934; (ii) a registered investment adviser under the Investment Advisers Act of 1940; or (iii) a financial or tax planner, and does not offer legal, financial, investment, or tax advice. Nasdaq Private Market is operationally independent and distinct from the Nasdaq Stock Market LLC. Securities-related services are offered through NPM Securities, LLC (“NPMS”), a member of FINRA and SIPC. Registered representatives of NPMS do not (i) advise any person on the merits or advisability of a particular investment or transaction; (ii) assist in the determination of fair market value of any security or investment; or (iii) provide legal, tax, or transactional advisory services.

The information contained herein is provided for informational and educational purposes only. None of the information provided represents an offer to buy or sell, or the solicitation of an offer to buy or sell, any security, nor does it constitute an offer to provide investment advice or service. Any information relating to company financing, valuation, or capitalization information should be independently verified by you in connection with any investment decision. The material is based in part on information from third-party sources that we believe to be reliable, but which have not been independently verified by us and for this reason we do not represent that the information is accurate or complete. There may exist other material non-public information that impacts the valuation of any securities. Past performance is not indicative of future results.

Investing in private company securities is not suitable for all investors. It is highly speculative and involves a high degree of risk. You must be prepared to withstand a total loss of your investment. Private company securities are also highly illiquid and there is no guarantee that a market will develop for such securities. Each investment also carries its own specific risks and you are strongly encouraged to conduct your own independent due diligence regarding the investment, including obtaining additional information about the company, opinions, financial projections and legal or investment advice.