Invest Intelligently in Pre-IPO Companies

Sign up now to access the SecondMarket® trading marketplace from NPM. Explore current inventory, submit orders to buy or sell, and view data on industry disruptors.

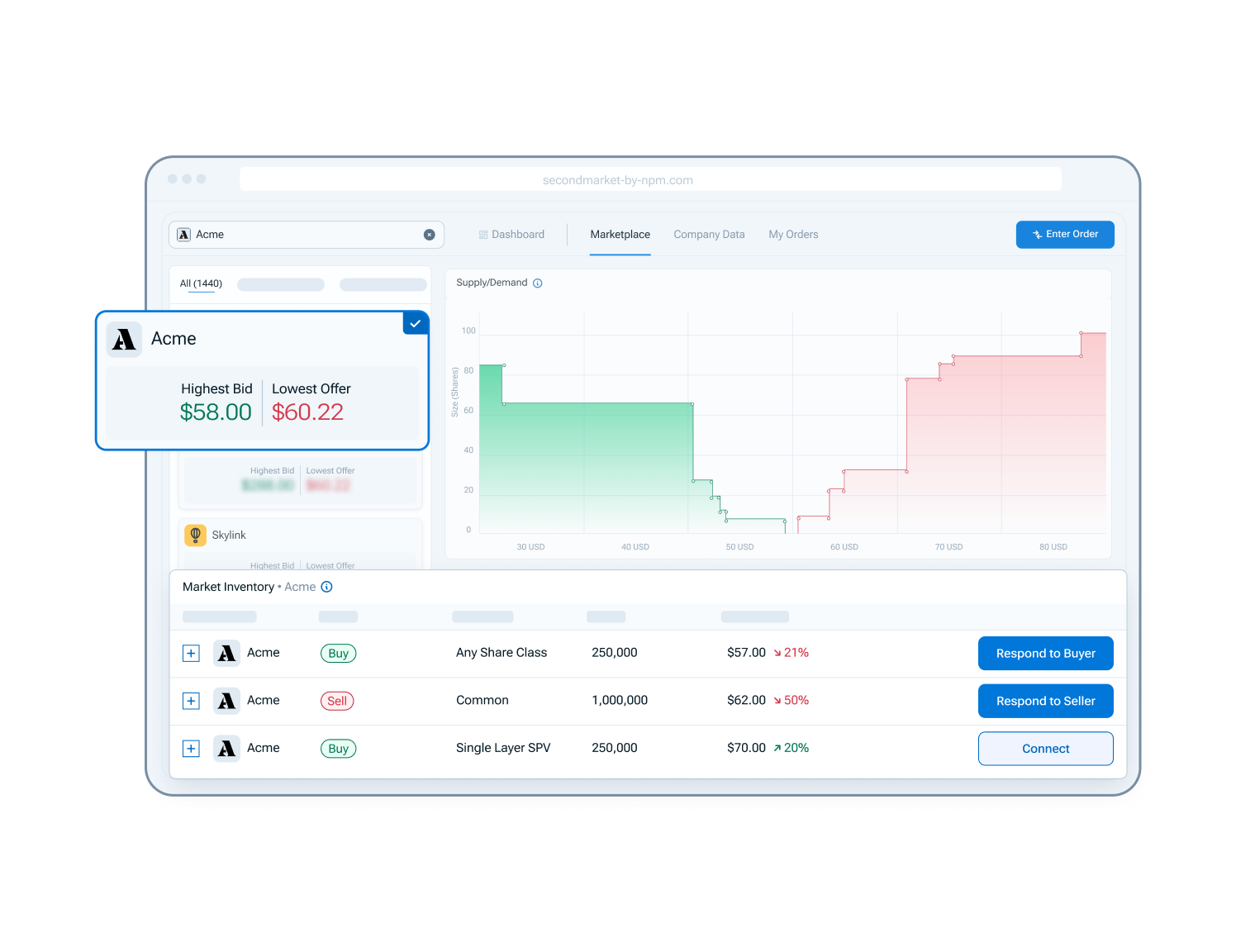

Trading Marketplace

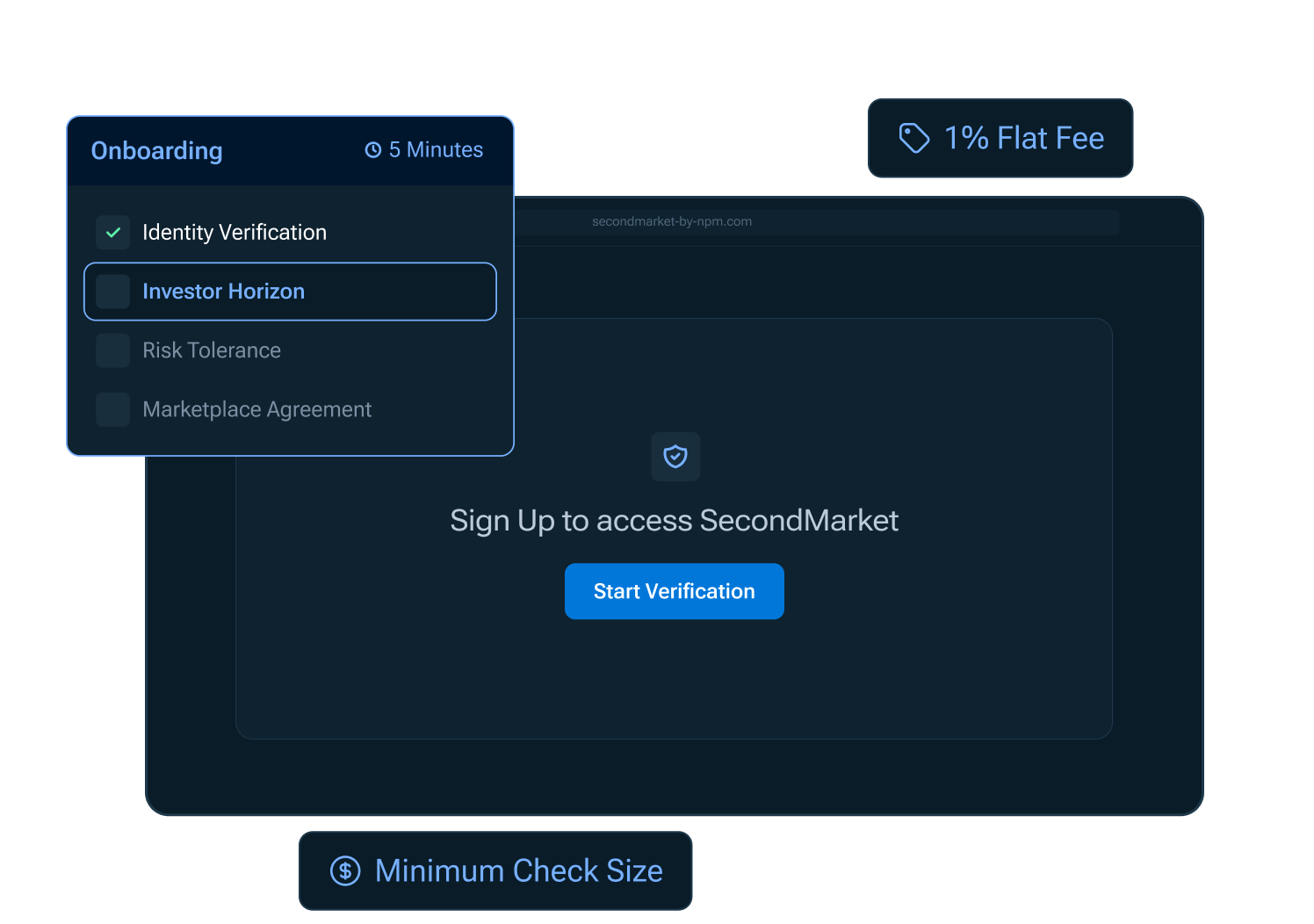

Sign up to get started. Onboard to access the trading marketplace. Explore buying and selling opportunities.

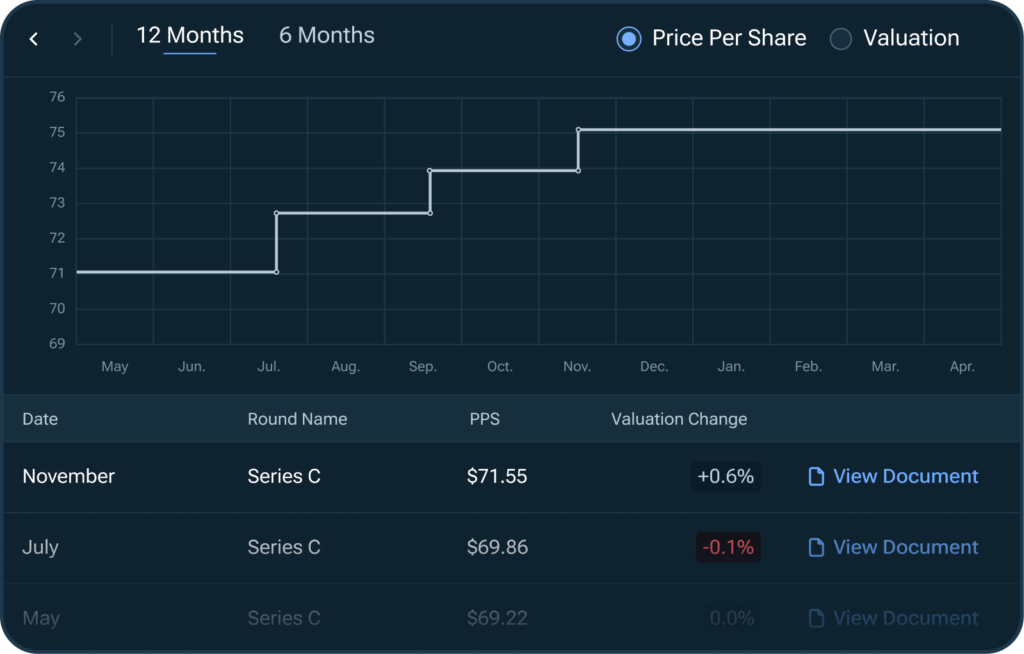

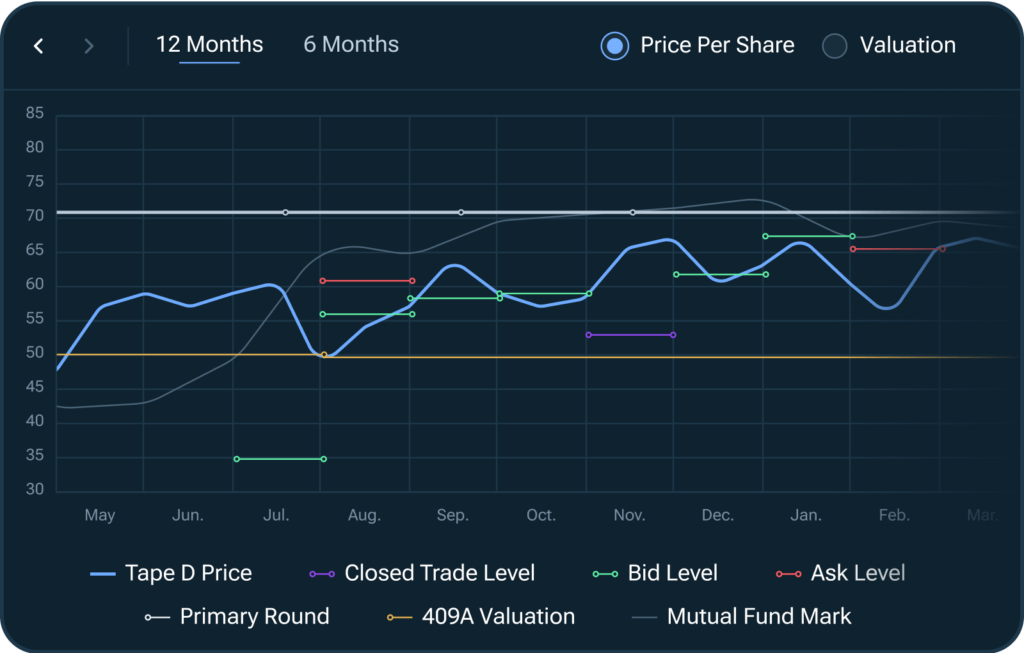

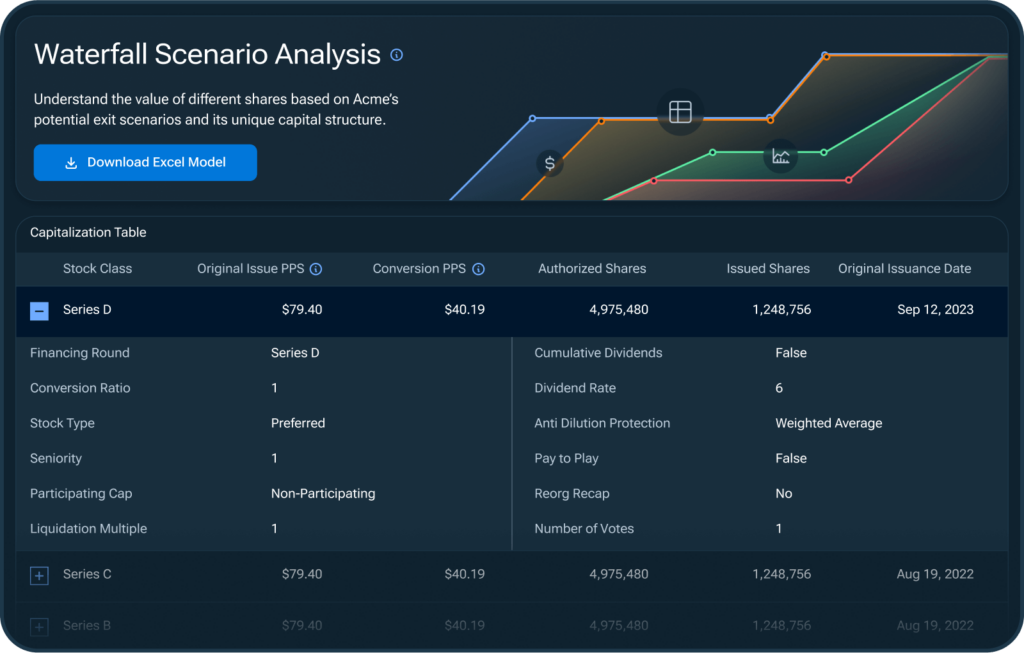

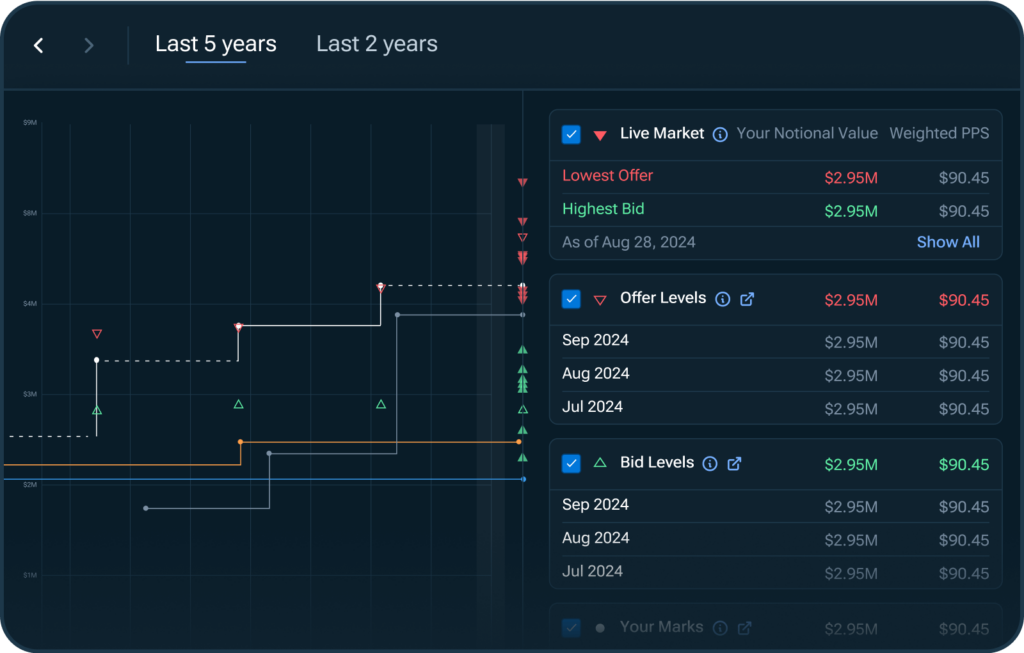

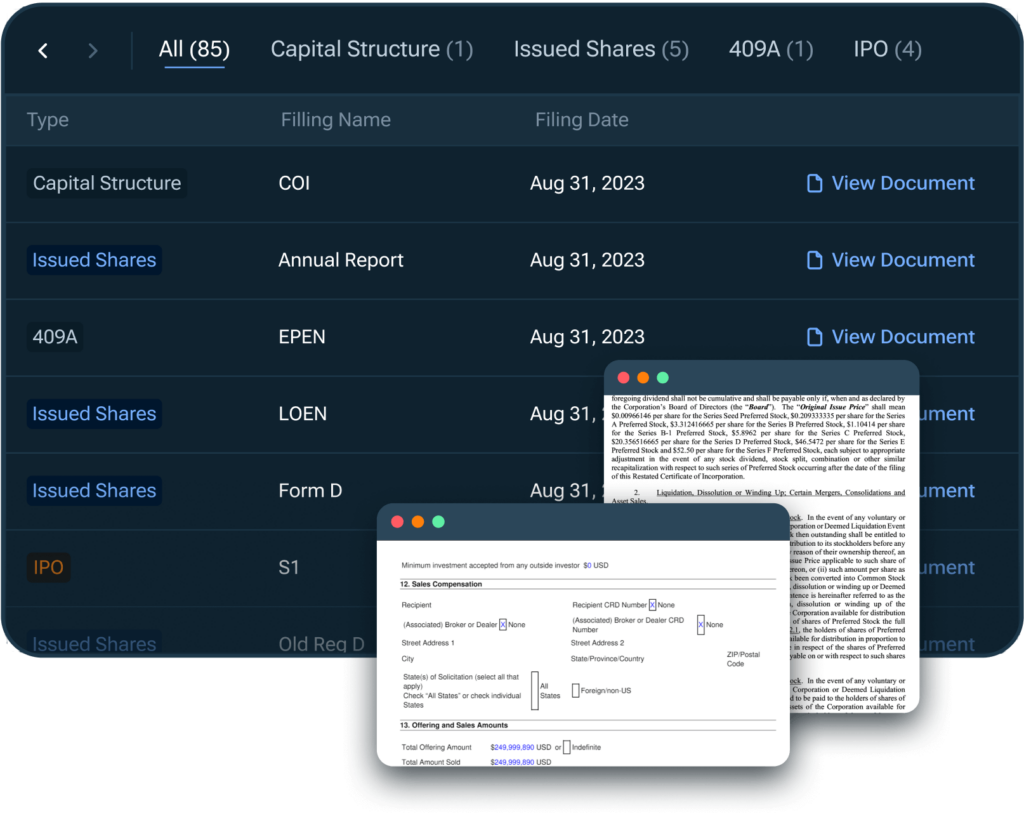

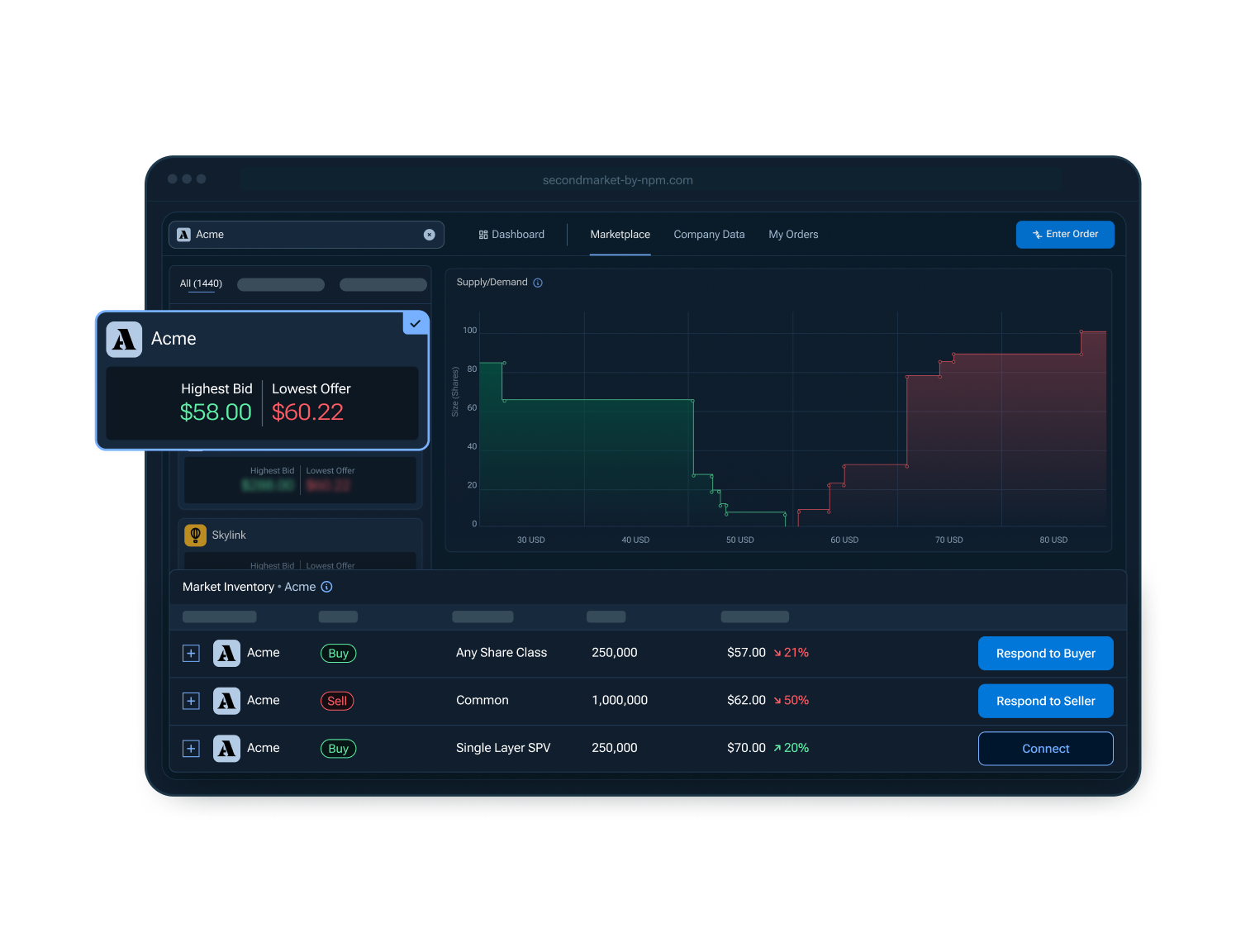

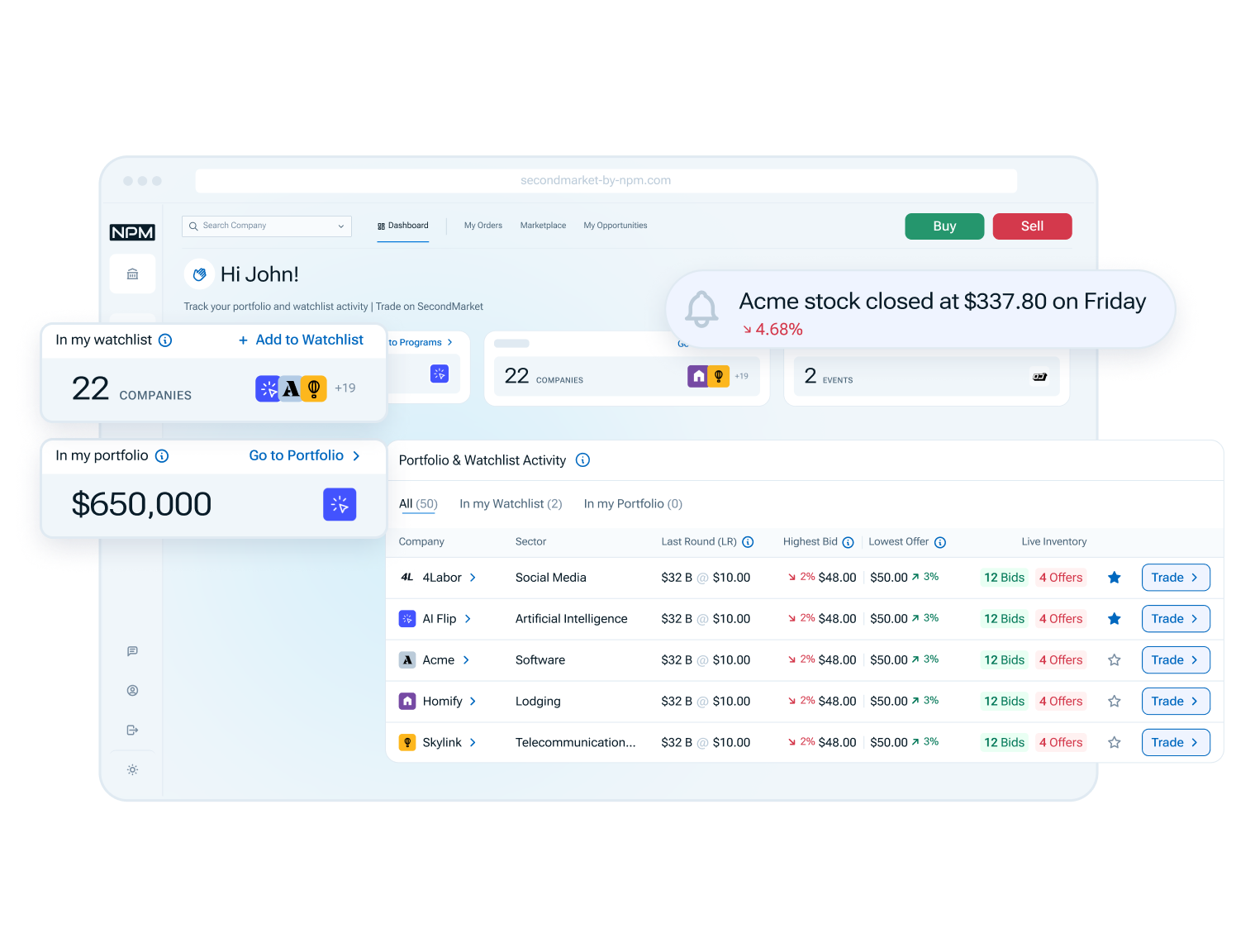

Evaluate Pricing Data + More

Via our comprehensive platform, we provide actionable data to help inform your trading decisions.

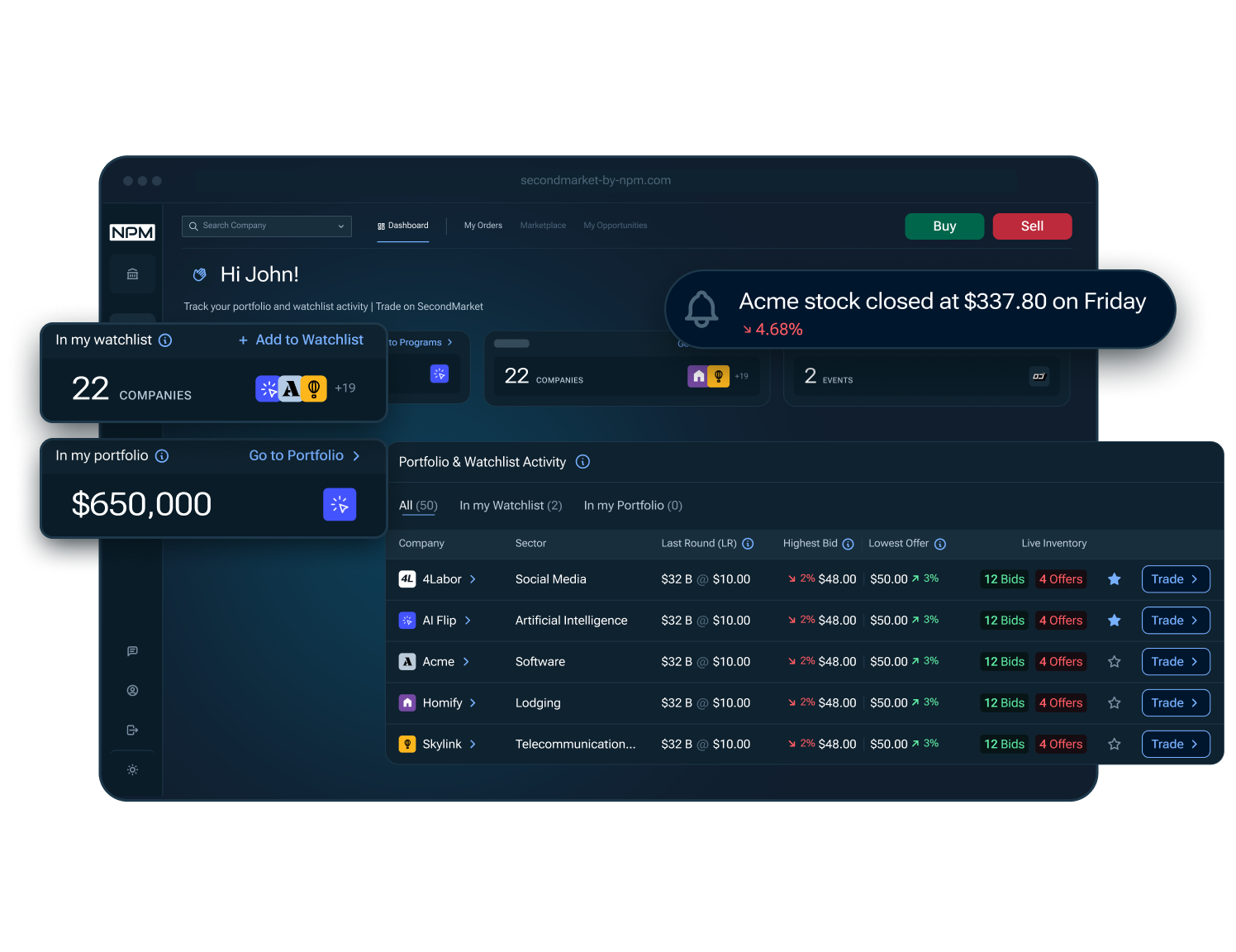

Track Portfolio + Watchlist Activity

Manage your portfolio and watchlist, set up notifications, track companies of interest.

Free to Sign Up.

Gain access to opportunities to invest in pre-IPO startups and sell shares seamlessly.

Buyers and sellers can access the exclusive NPM network of issuers, employee shareholders, institutional investors and other market participants.

Who Can Buy Shares?

NPM provides access to a broad range of investors who meet the eligibility criteria.

Institutional Investors

Asset managers, hedge funds, sovereign wealth funds, family offices, venture capital firms, private equity, and RIAs.

Accredited Investors

Individuals that meet specific financial thresholds, such as income, net worth, or specific financial licenses.

Entities

Limited liability companies, partnerships, trusts, small family offices, and corporations.

Self-Directed IRA Holders

Individuals that manage their own self-directed individual retirement accounts (SDIRAs).

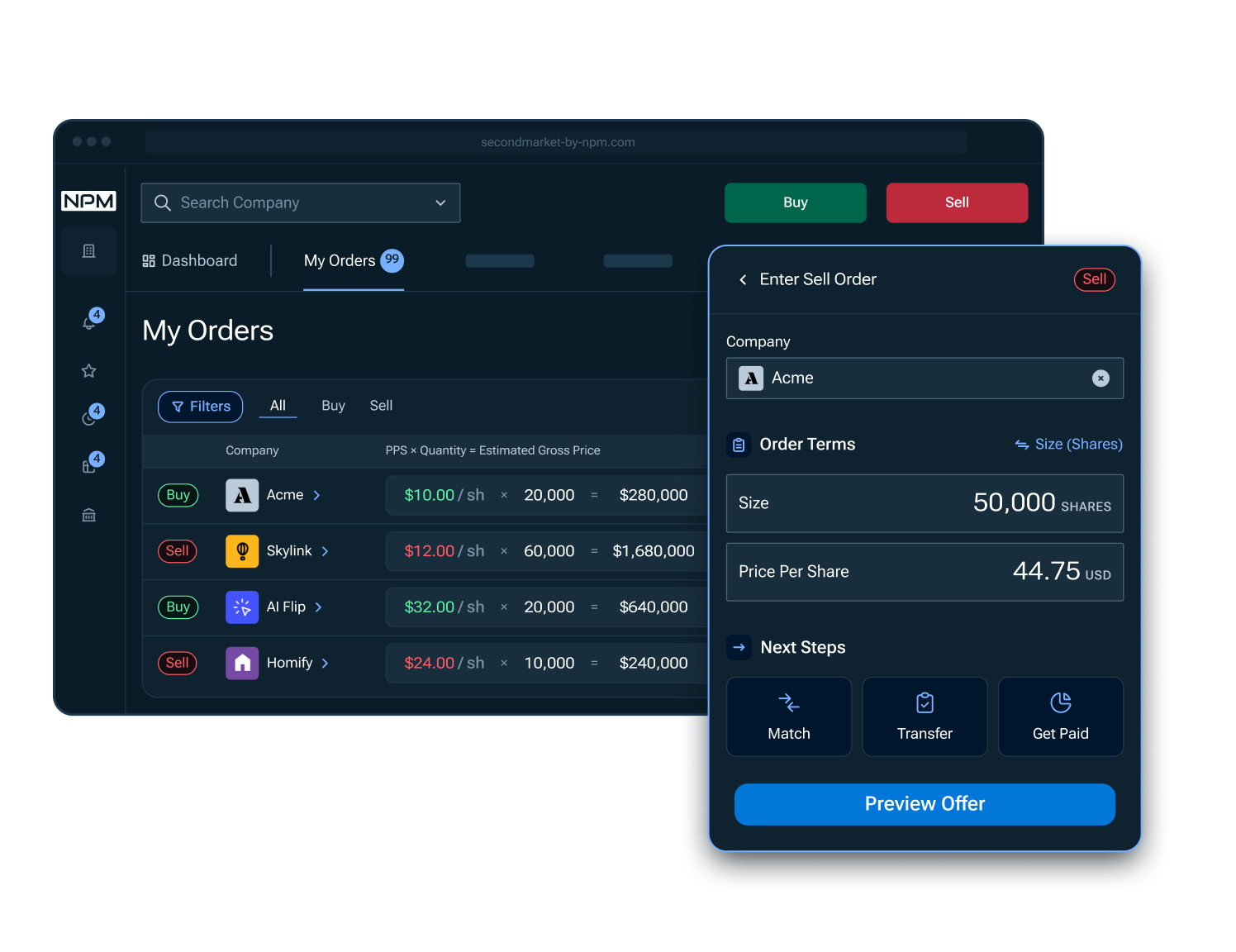

Post a Buy or Sell Order + Match With an Existing Seller or Buyer

To buy stock, place a new bid to buy shares onto the marketplace or respond directly to an existing seller’s offer and start a negotiation. To sell shares, add your holdings and post a new offer on the marketplace or respond directly to a buyer’s bid and start a negotiation.

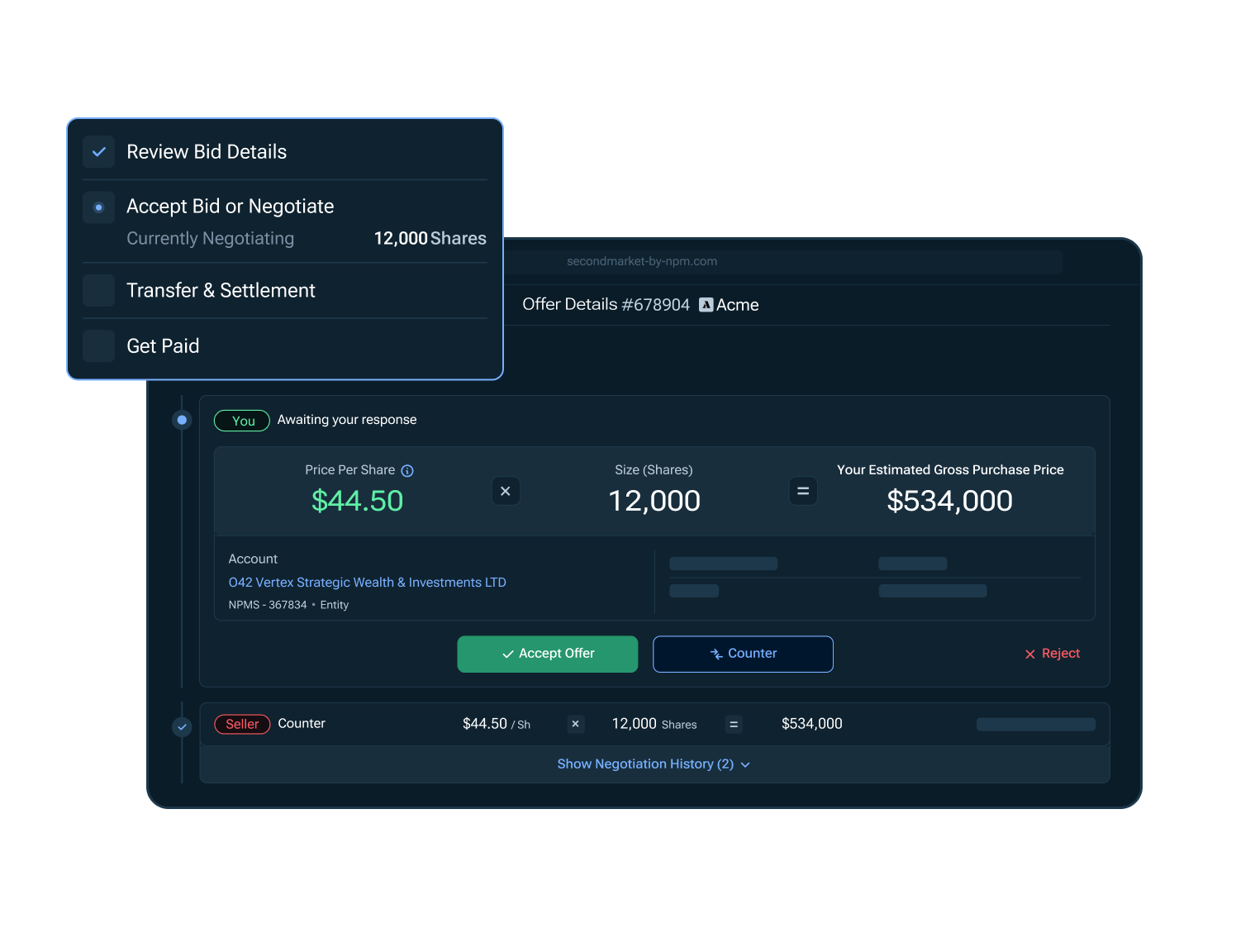

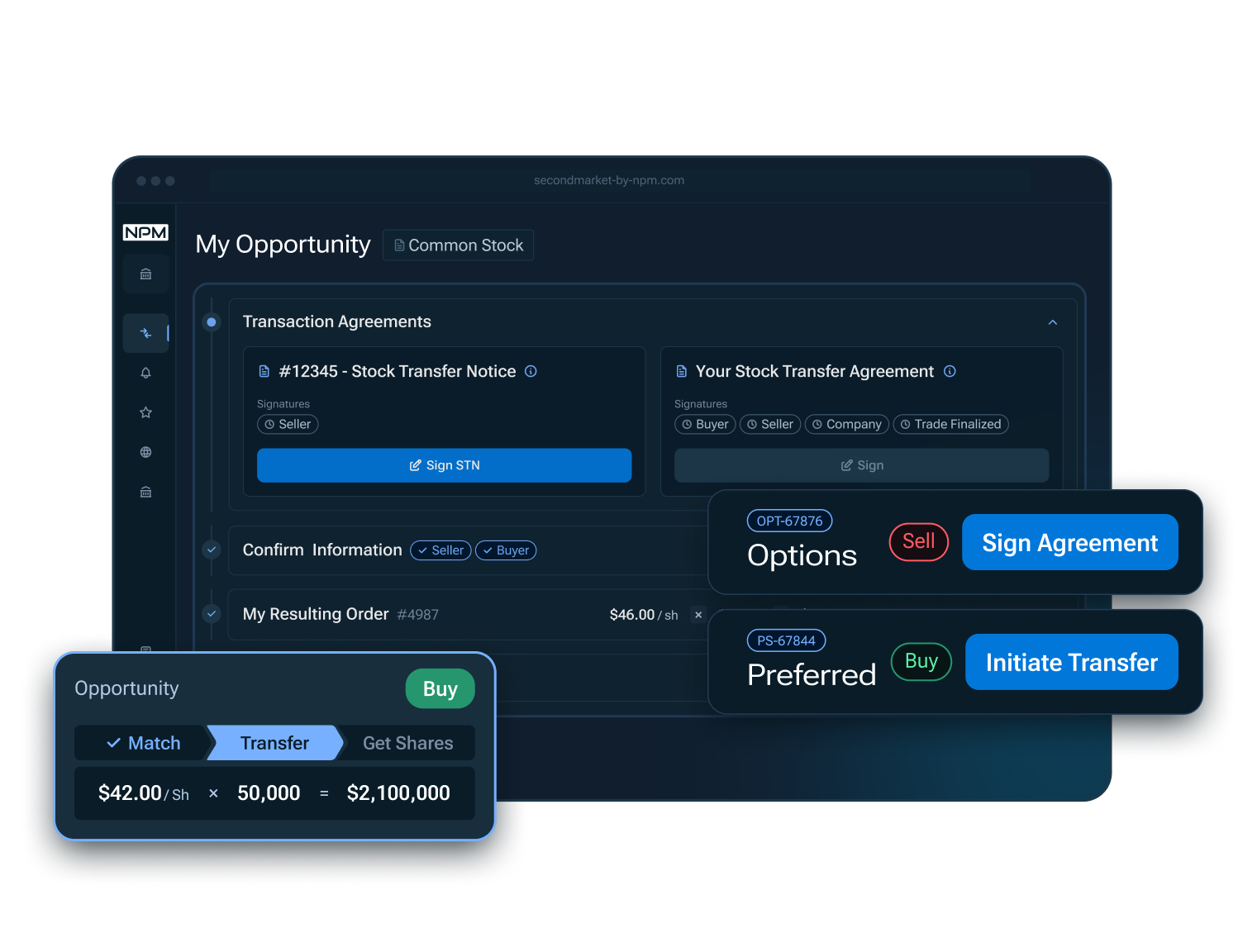

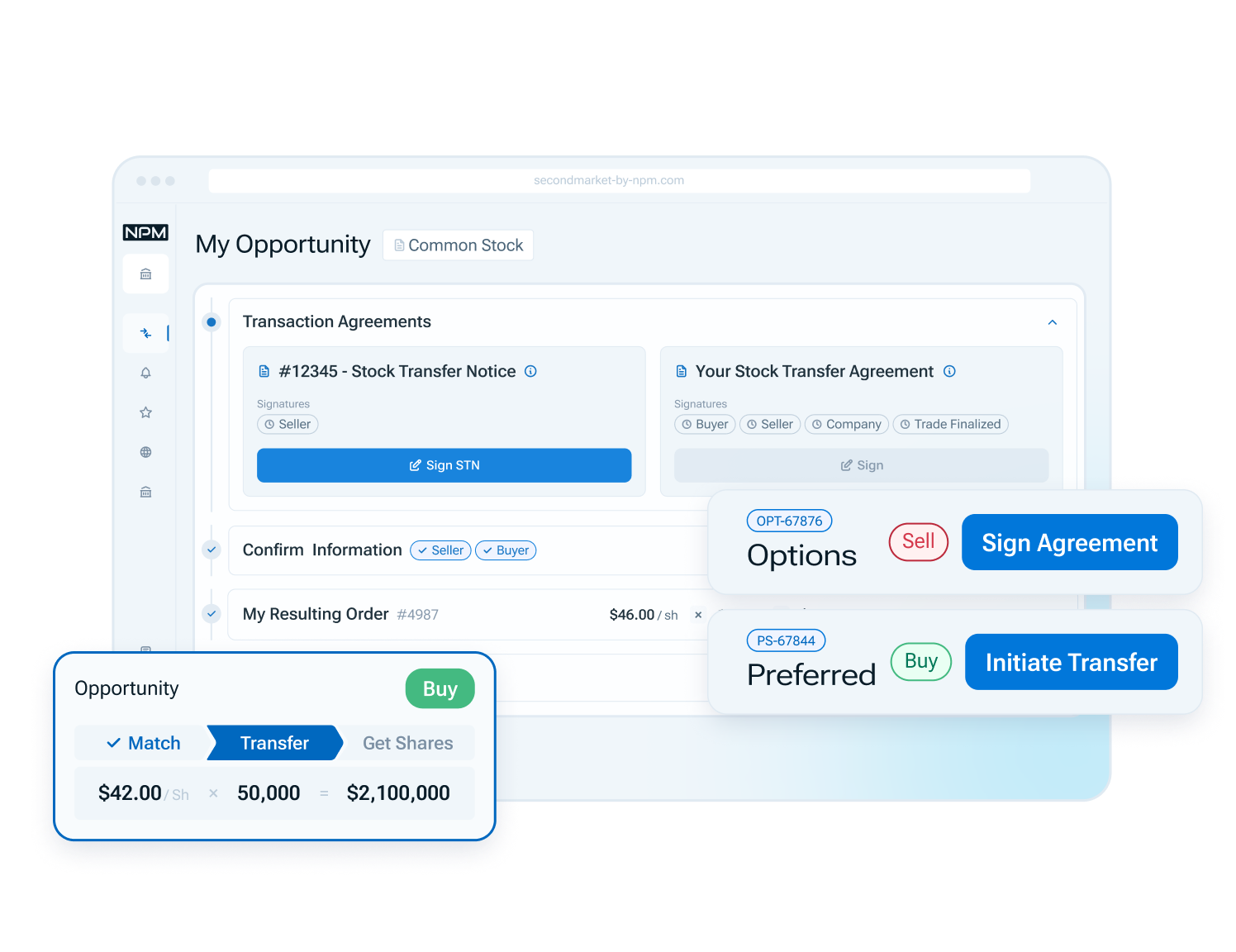

Negotiate With Counterparty

Buyers and sellers have visibility throughout the whole transaction process and can directly negotiate live bids and offers. Once buyers and sellers agree to terms, transactions move forward within the platform.

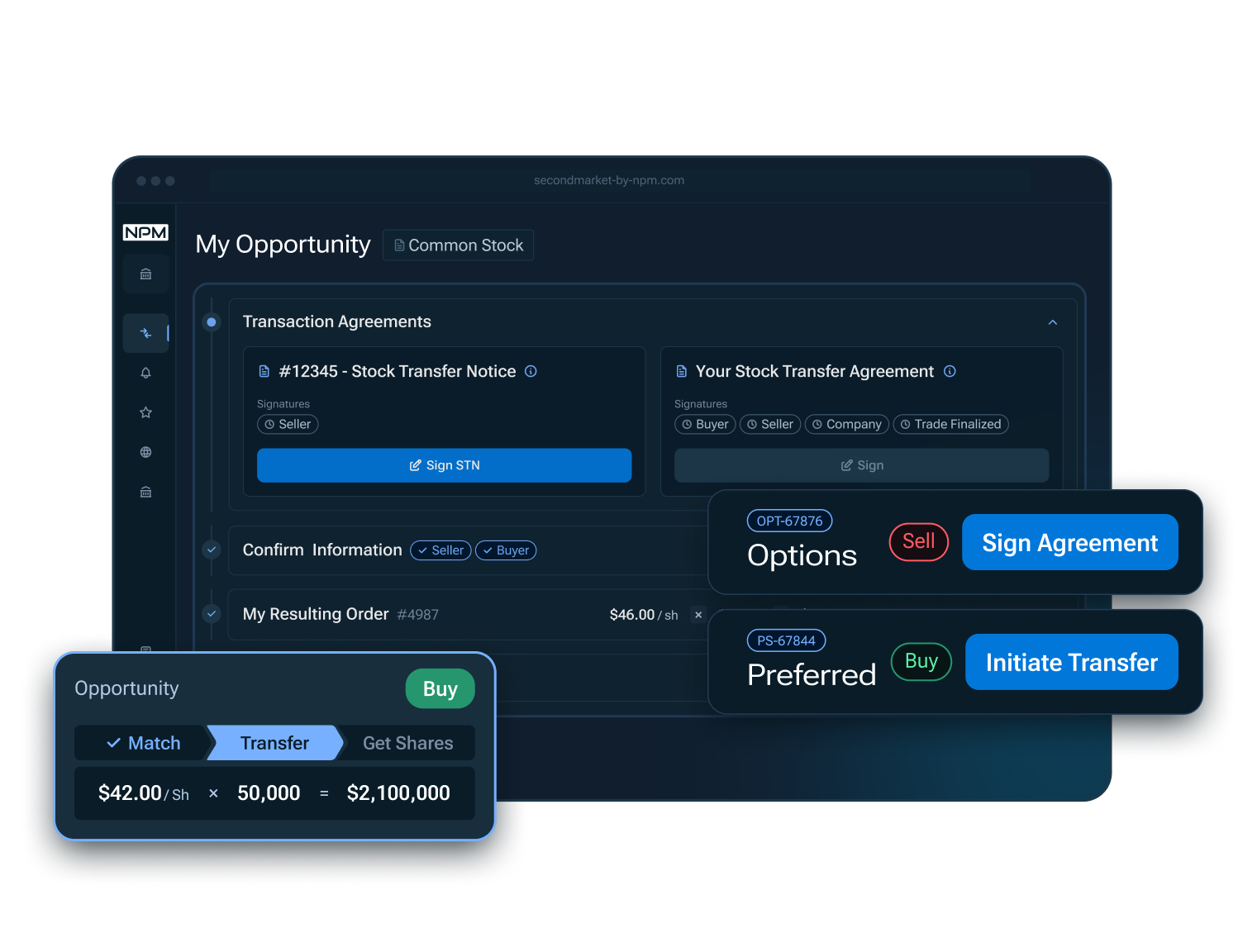

Transfer Funds + Settle Shares

Proprietary Transfer and Settlement technology from NPM helps buyers manage transfer activity from match to settlement, fast tracking transfer of funds alongside the company equity administration team.

Trading Marketplace

01Self-service access to an online platform for secondary transactions. SecondMarket from NPM offers a transparent marketplace for buying or selling private company stock across unicorns, startups and other pre-IPO companies.

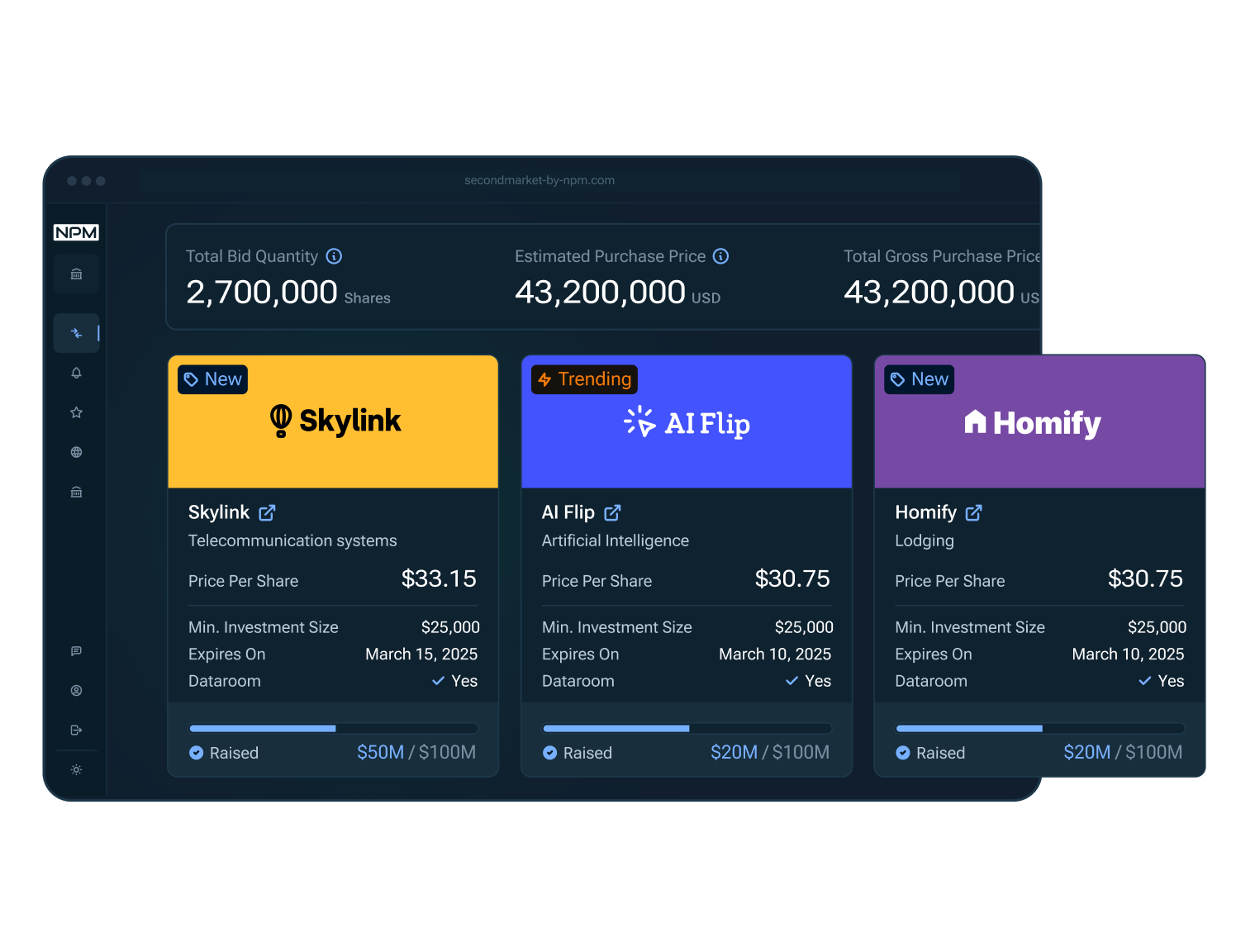

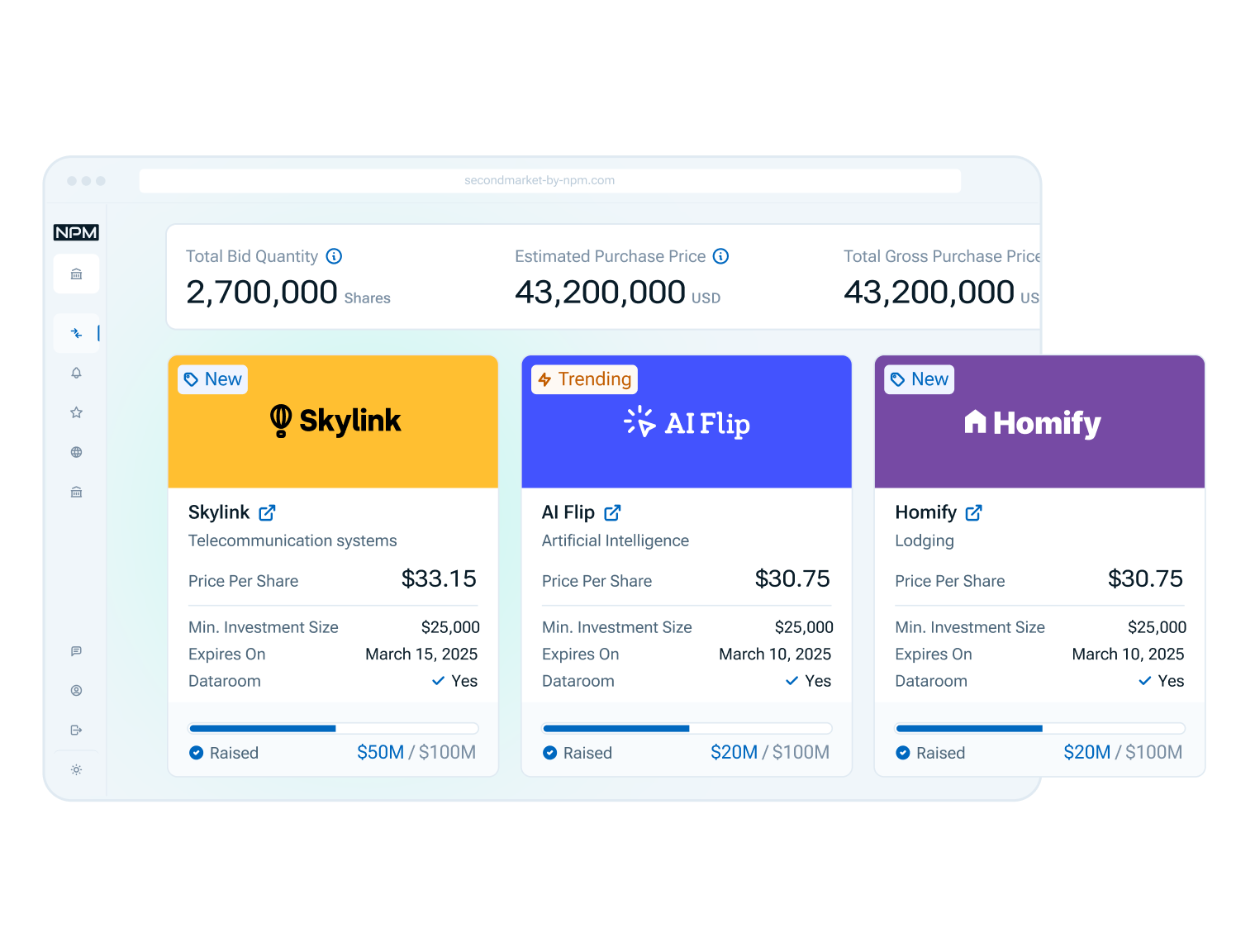

Invite-Only Transactions

02Exclusive opportunities to invest in pre-IPO companies. Gain access to private market programs facilitated by NPM including tender offers and other company-sponsored transactions.

Portfolio + Watchlist

03Track the value of shares, ongoing market activity, funding rounds, and price changes. Create a watchlist of companies you want to invest in and receive notifications on the platform or in your inbox.

Settlement Technology

04Track transfer activity in real-time. Streamline stock transfer notices and management of investor documents. Simplify payments to ensure seamless delivery of funds.

Wealth Connect

After a transaction, connect with a wealth advisor.

Learn More eastFind a Financial Advisor

Match with independent financial advisors for expert advice.

(Select NPM Clients Eligible)

- Connect with advisors well suited to meet your needs.

- Navigate the complexities of business and personal finances.

- Structure finances to fund life events and plan for wealth transfer.

Set Up a Robo-Advisor Account

Sign up for a robo-advisor or start DIY investing.

(All Shareholders Eligible)

- Low fee, easy to use investment platform.

- Rebalancing, reinvesting and tax-loss harvesting.

- Build a portfolio based on your investment goals.

Open A High-Yield Online Savings Account

Enroll in a premium savings account with competitive APY.

(All Shareholders Eligible)

- No fees. No minimum deposit. FDIC insured.

- Free same-day withdrawals and unlimited transfers.

- Monitor accounts online or in app.

Select a Multi-Family Office

Consult an independent advisory firm to help find, diligence, and compare family office solutions. (Select NPM Clients Eligible)

- Manage family wealth across investments, planning and tax strategy.

- Leverage a team of professionals to tailor your investments.

- Manage equity awards and family governance.

Most Viewed Companies

Source: NPM Data

Demystifying Private Company Investing.

How do I create an account?

01Click here to create an account and get started.

Am I eligible to buy private company stock?

02Institutional investors, individual accredited investors, accredited entity investors, and self-directed IRA holders are eligible to buy and sell stock on the NPM SecondMarket® Trading Marketplace. To determine whether you meet these definitions, refer to the link below: (https://www.sec.gov/resources-small-businesses/capital-raising-building-blocks/accredited-investors).

How do I buy private company stock?

03To buy private company stock, create an account on the NPM SecondMarket platform. Once onboarding is complete, you can buy from existing offers (sell orders) or place a bid (buy order) for the company of interest.

Click here to create an account and get started.

How do I sell private company stock?

04To sell private company stock, create an account on the NPM SecondMarket® platform. Once onboarding is complete, upload your holdings of the private company you own. After holdings are uploaded, you can post an order to sell shares from the applicable holdings and specify order details such as size and price you would like to sell on the platform. Orders can also be sold by responding to an existing buyer on the platform who has indicating interest in a specific company.

What role does NPM play?

05NPM is a registered broker-dealer and offers a platform that connects buyers and sellers. Upon a successful matched trade, NPM manages the transaction process from end to end with the company, the buyer, and seller. The transaction process includes noticing the company of the transaction, facilitating the communication between buyer, seller, and company, as well as the settlement process. NPM draws upon over a decade of experience working with hundreds of private companies and more than 200,000 individuals on secondary transactions to help facilitate a smooth selling and buying experience for clients.

How is price determined?

06- The price is determined by buyers and sellers in the marketplace. Buyers submit the price they would like to pay for shares and sellers submit the price they are willing to sell their shares. Read more about bids and offers, here.

- Additionally, NPM Tape D® premium data provides extensive private company insights including company profile information, valuation data, cap table and waterfall analysis, financing rounds, and proprietary share prices. To access the full universe of data available, subscribe to our premium data package that can be purchased through the NPM data team. Inquire here.

What fees does NPM charge?

07NPM charges an equitable fee to both buyer and seller on any trades that successfully match and settle through our platform. There are no fees to submit an order or to simply open and maintain an account with NPM.

How long does the transaction process take?

08The end-to-end post-match transaction process typically takes 30-45 business days. Once a trade is matched between buyer and seller (in terms of dollar amount, price per share, share class, and share quantity), NPM notices the company. After the company acknowledges the order, the right of first refusal (ROFR) process begins and is typically a 30-day window for the company to approve the transfer and circulate the appropriate documentation, including the stock transfer agreement, to confirm the transfer of stock from seller to buyer.

Does the company need to approve every transaction?

09Most shares are subject to standard transfer restrictions that give the company the discretion to either approve or reject a secondary transfer of shares. The company may also choose to exercise the right of first refusal (ROFR).

What are the benefits of opening a NPM SecondMarket® account?

10Opening an NPM SecondMarket account and completing the onboarding module provides access to the marketplace, the data platform, a portfolio monitoring tool, and potential invites to company-sponsored tenders offers or other programs, where NPM is facilitating capital introduction or SPV (special purpose vehicle) opportunities.

Click here to create an account and get started.

What is the minimum transaction size?

11The minimum transaction size is $25,000 per order.