Private Companies

Technology, network, and experience to manage employee + shareholder liquidity needs.

Opportunities for Each Stage of Growth: Multiple Products. One Partner.

Create a Program eastTools That Empower Private Companies. Programs That Reward Equity Holders.

Create a Program eastReward + Retain Employees ↓

Provide company-sponsored opportunities for employees to sell shares earned from their equity compensation plans.

Company-Controlled + Designed ↓

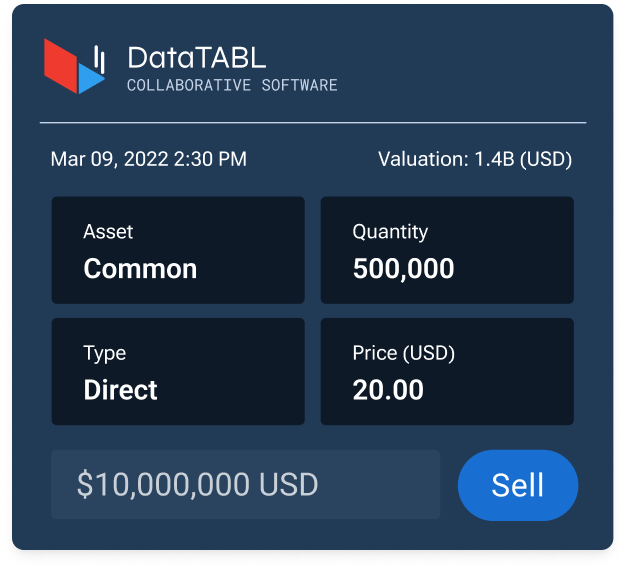

Customize program trading parameters and track participation across eligible shareholders and employees.

Relationships with Active Institutional Investors ↓

As an extension of your business, we introduce shareholders to investors through an interconnected network of institutions, banks, and brokers.

Transfer + Settlement Management ↓

Our streamlined technology helps manage share activity from match to settlement and creates control for equity administration teams.

Consolidate Trades ↓

Offer controlled and organized equity liquidity programs on one centralized, efficient platform.

Programs + Products

Multiple corporate programs and secondary market products to address shareholder liquidity needs.

Experience + Expertise

As an industry pioneer with a decade of experience, we’ve facilitated liquidity programs for some of the world’s premier private companies.

Capital Introductions

Expand investor base by tapping into new pools of institutional capital sourced from our network.

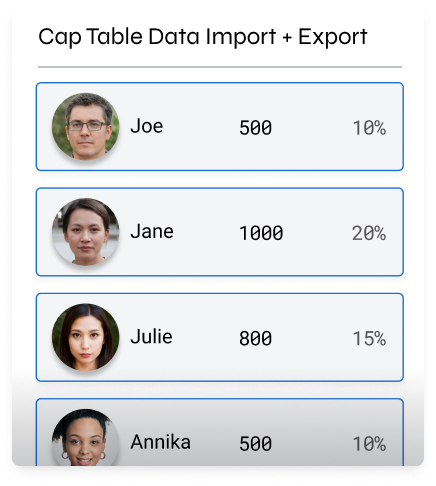

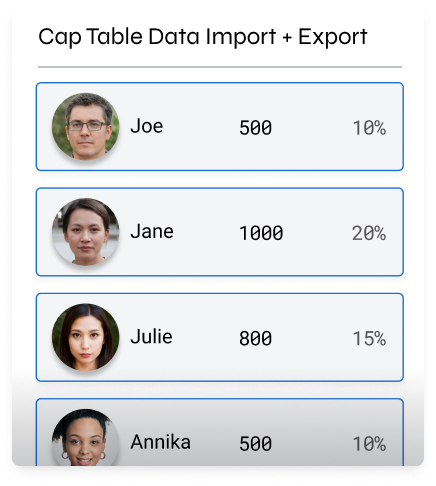

Cap Table Transfer

Professional expertise to fast track cap table import / export and the transfer of shareholder data.

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of Jan 2025

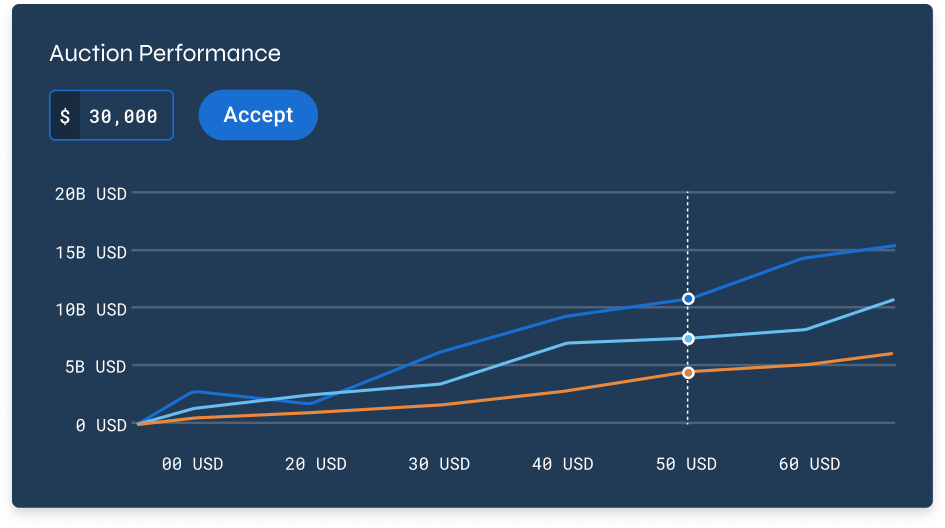

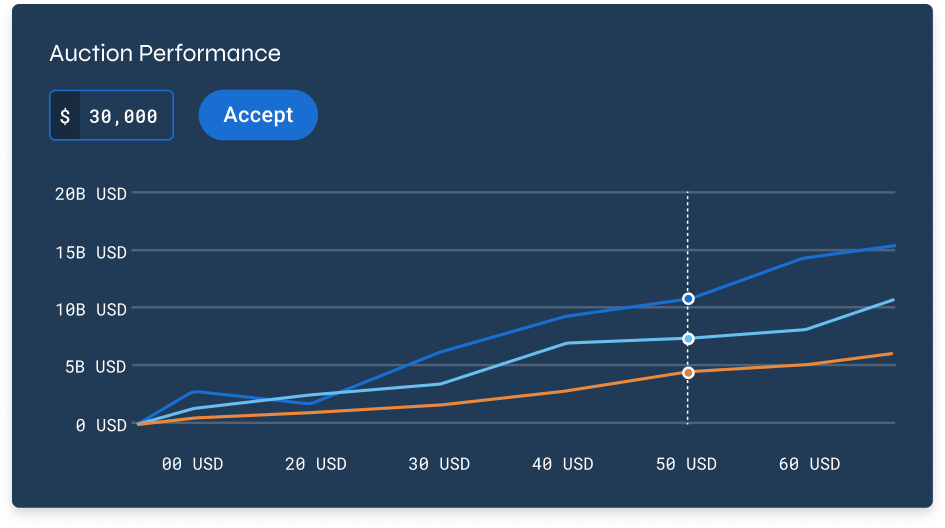

Access Institutional-Grade Metrics + Analytics

Top Referring Law Firms for Private Company Transactions

-

Goodwin

-

Cooley

-

Latham & Watkins

-

Gunderson Dettmer

-

Simpson Thacher

-

Fenwick & West

-

Wilson Sonsini

-

Kirkland & Ellis

-

Caiola & Rose

-

Paul Hastings

- Company Counsel

- Buyer Counsel

Client Industry Breakdown

Information Technology

49%

Information Technology

49%

Financials

19%

Financials

19%

Health Care

9%

Health Care

9%

Consumer Discretionary

9%

Consumer Discretionary

9%

Industrials

7%

Industrials

7%

Communication Services

4%

Communication Services

4%

Consumer Staples

3%

Consumer Staples

3%

Our Recent Client Valuations

- 15% $0-$250M

- 7% $500M-$1B

- 8% $1B-$2B

- 38% $2B-$5B

- 33% $5B+

Global Client + Investment Network

- 🇦🇺 Australia

- 🇧🇲 Bermuda

- 🇧🇷 Brazil

- 🇨🇦 Canada

- 🇰🇾 Cayman Islands

- 🇨🇴 Colombia

- 🇪🇪 Estonia

- 🇫🇮 Finland

- 🇫🇷 France

- 🇩🇪 Germany

- 🇭🇰 Hong Kong

- 🇮🇩 Indonesia

- 🇮🇱 Israel

- 🇯🇵 Japan

- 🇱🇹 Lithuania

- 🇱🇺 Luxembourg

- 🇲🇽 Mexico

- 🇸🇬 Singapore

- 🇨🇭 Switzerland

- 🇸🇪 Sweden

- 🇺🇦 Ukraine

- 🇬🇧 United Kingdom

- 🇺🇸 United States

Data as of Jan 2025