Pre-Direct Listing Liquidity Programs

A platform for private companies to design their own continuous secondary marketplace.

This Product Helps:

- Private Companies

As Companies Prepare for a Direct Listing, We Collaborate to Design Marketplaces that Meet Shareholder and Investor Objectives.

Our custom marketplaces are transparent, operationally efficient, and promote price discovery ahead of going public.

Create A Marketplace east

Helping You Transition to Your Next Stage of Growth

Proven Success

Facilitated a total of $45B+ in program value across 160K+ eligible participants in 650+ company-sponsored programs of which 250+ companies reached unicorn status.

Experienced + Regulated Intermediary

As a seasoned intermediary for hundreds of private company transactions, our team facilitates a variety of complex client liquidity programs.

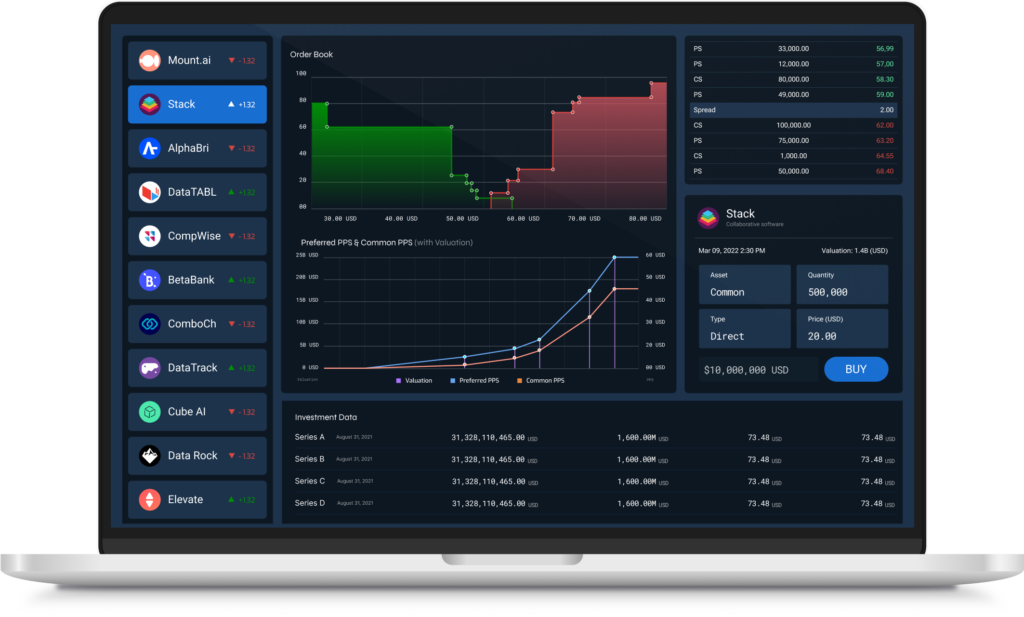

Centralized Trade Data

A transparent marketplace tracking bids and asks into an order book allowing for companies to keep a pulse on market supply and demand.

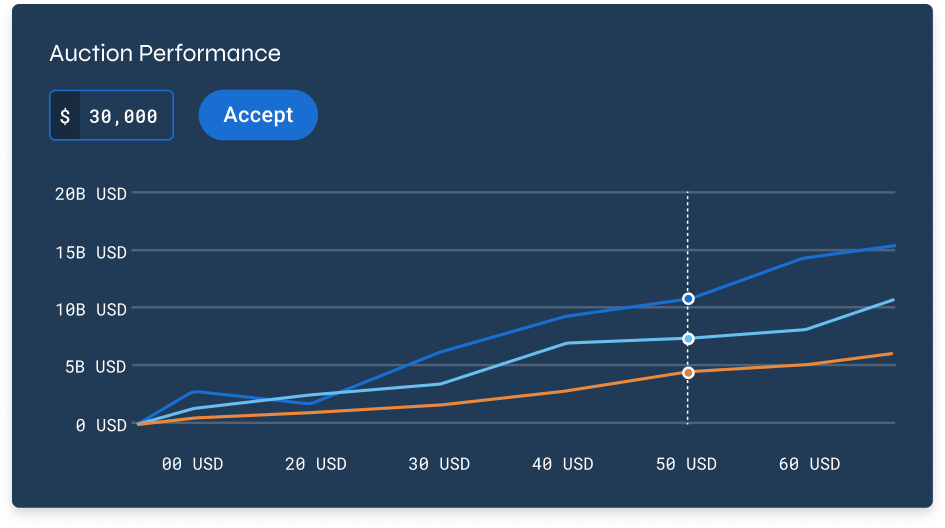

Price Discovery + Institutional Demand

By providing late-stage growth private companies access to institutional bids, we offer a key market indicator of demand and price to build new relationships as companies prepare to enter the public market.

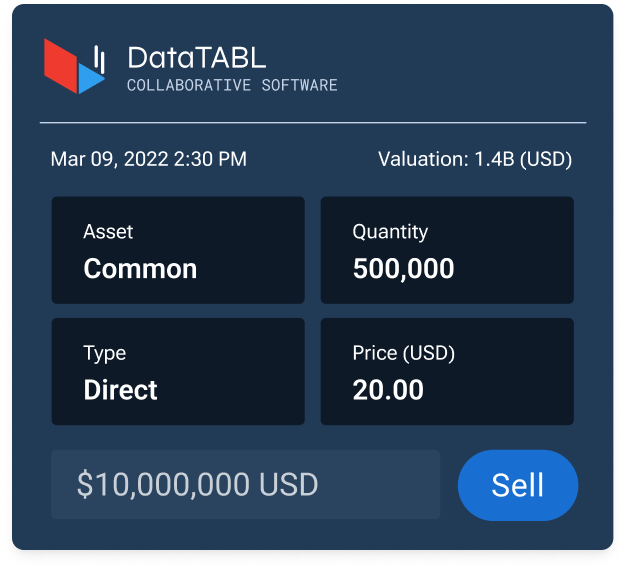

Company-Sponsored + Customized

Companies control the offering and customize their program to meet specific shareholder needs, investor requirements, and company goals.

Technology Designed for Companies

Trading marketplaces are built and executed via our modular, cutting-edge trading technology that offers companies complete control and oversight throughout the entire lifecycle.

Build Recurring Windows of Liquidity

Company marketplaces batch secondary activity providing shareholders and investors with a market-driven price.