Auctions + Capital Introduction

Generate competitive market-driven pricing through a centralized offering for your investors, employees, and shareholders.

This Product Helps:

- Employees + Shareholders

- Private Companies

- Investors

Programs to Reward Employees + Introduce Capital

Tools to Address Shareholder Liquidity Needs

- Advanced Auction Technology

- Highly Customizable Platform

- Company-Defined or NPM Sourced Buyers

Program Participant Support From End to End

- Customized Onboarding Setup

- Guidance to Optimize Your Program

- Settlement to Expedite Cash Payment

Premier Secondary Trading Platform for Auctions Built for Employees + Shareholders.

As companies stay private longer and investor demand remains high, we offer secondary auctions that provide competitive pricing for liquidity and allow shareholders to have more control throughout transactions.

A Decade of Private Market Experience

Customizable Parameters

Auctions provide the same level of customization, if not higher, than standard private company tender offers. Companies can name price floors and ceilings, project or limit the amount eligible to be sold in the transaction.

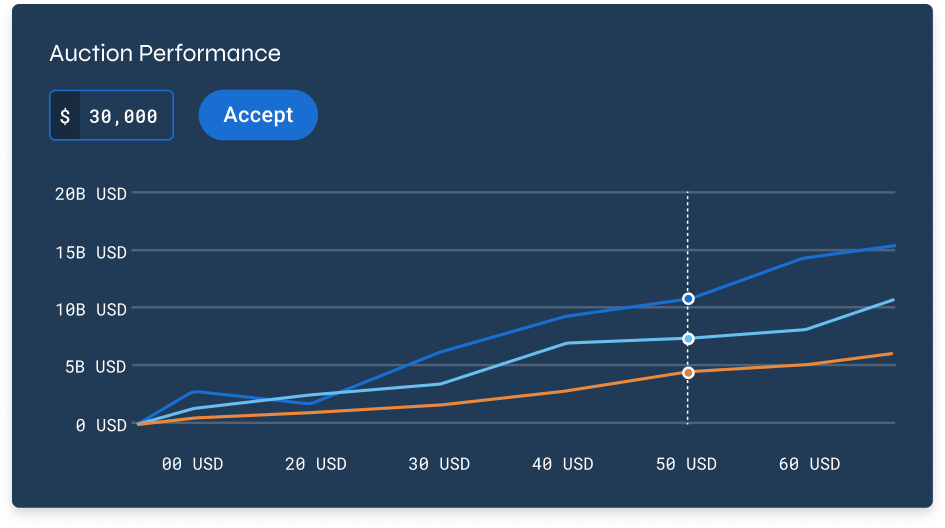

Competitive Price Discovery

Companies that run auctions may benefit from competitive price discovery from sophisticated, institutional buyers, which generally leads to more transparent clearing price calculations.

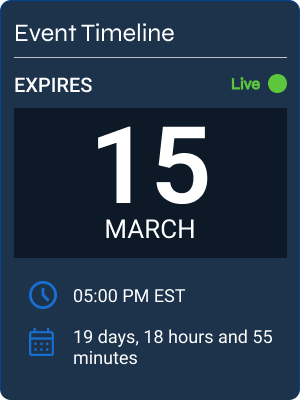

Time to Liquidity

Depending on the structure, companies may be able to carry out company-wide auctions in less time than it takes to hold a traditional tender offer, mainly due to the 20-business day mandatory tender offer window.

Transparency

Utmost visibility into bids, offers, closing prices throughout the auction for investors and shareholders. Companies maintain control with tools to monitor and adjust activity from start to settlement.

Advanced Technology

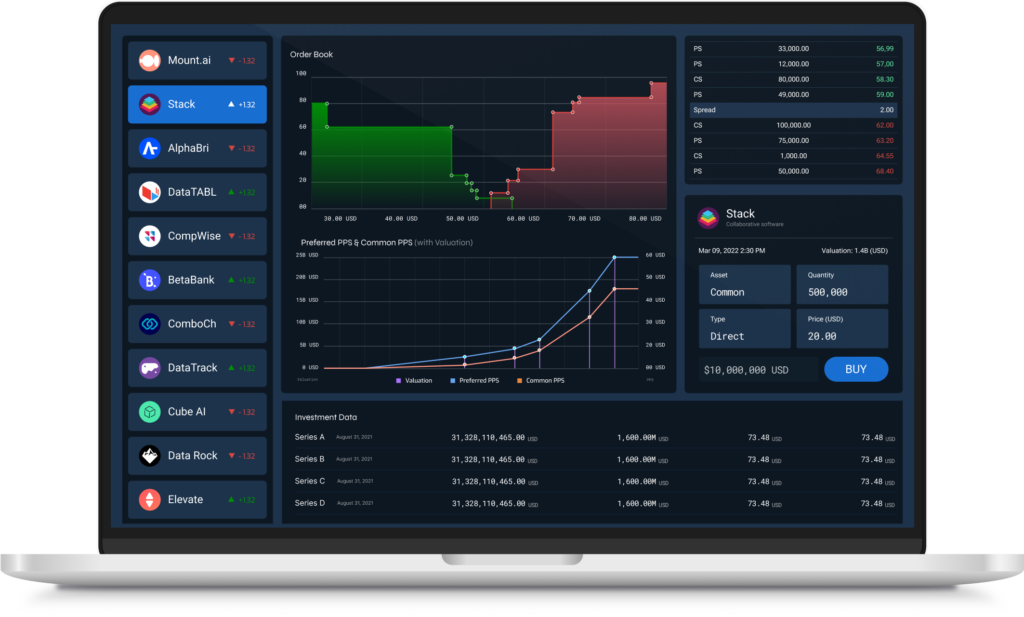

Flexible workstation with ability to host and configure different types of auctions based on company parameters and participant data. Tools to negotiate and collect all bids and offers in a sealed manner.

Settlement Tools

Proprietary technology to automate and manage expedited share transfers from match through settlement. Unlocking settled funds faster.

Capital Introductions

- Matching company shareholders with approved institutional investors.

- Identify new sources of capital from investors who believe in your mission.

- Partnering with private companies to understand ideal investor profiles.

- Seamlessly import/export + verify additions to your cap table platform.

Reward + Retain Employees

Convert Employee Shares to Cash

- An intuitive process for employees to sell their equity.

- Centralized platform to manage documentation.

- Self service workstation to set share type and quantity.

- Automatic transfer of funds into seller accounts.

- Client success team for questions and assistance.

- Monitoring tools to track auction progress.

Build a Strong Company Culture

- Reward an employee-owner mentality.

- Align employee interests with the company’s.

- Incentivize growth by unlocking employee liquidity.

- Enhance company loyalty + reduce turnover.

- Attract top talent with actionable equity plans.

- Compete with public company employee equity.

Secondary Auction Technology for Your Stage of Growth

A central trading marketplace that connects your employees and shareholders with engaged investors. Tailored private market technology gives you the features you need to execute smart, streamlined transactions quickly and efficiently.

Streamlined + Simplified Process

Setup Auction ↓

- Sell-side participation determined

- Set auction parameters, maximum and minimum price, eligible participants

- Complete due diligence

Launch Auction ↓

- Open data room and bidding platform for participants

- Begin bidding process

- Company approves clearing price based on company preference

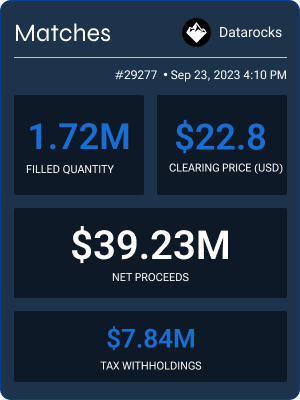

Facilitate Settlement ↓

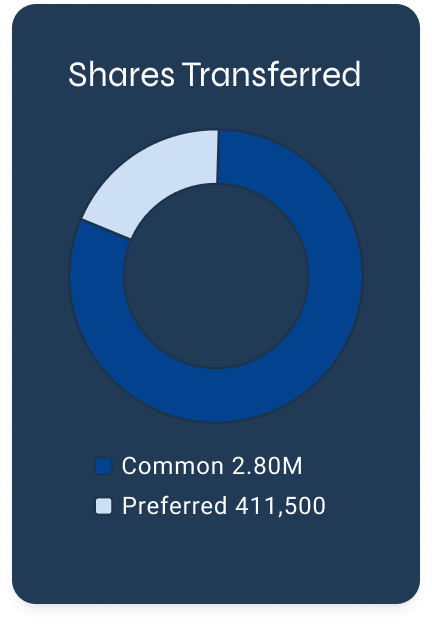

- Transfer shares between buyers and sellers

- Leverage settlement tools to expedite cash payment

- Receive performance reports and cap table data

Tax Tools ↓

- Auto generated Form 1099-B for tax reporting

- Referrals to tax advisors prior to participating in a auction

- High-touch client support for post-transaction tax considerations