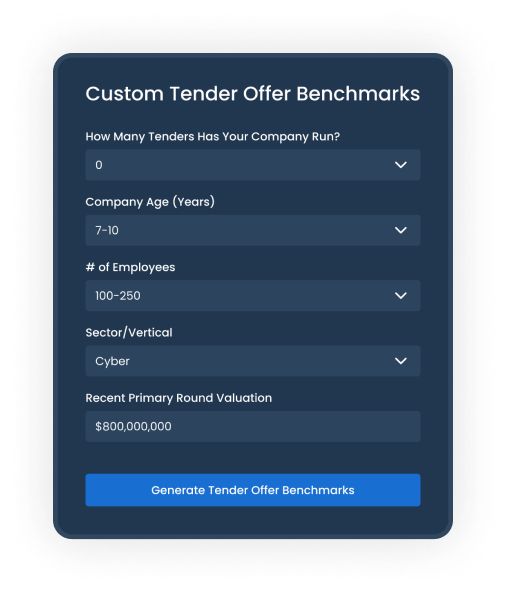

Explore Tender Offer Benchmarks

Nasdaq Private Marketu2019s Tender Offer Benchmarks provide management teams with hard-to-source information on typical pricing, structure, and performance.

Our reports offer visibility into the different levers available when designing a tender offer. Submit your information to receive a detailed report from our tender offer product specialists.

Who Benefits from This Report

Request Benchmarks eastCompany with No Program Planned

A company with no previous tender offer experience is interested in learning more about secondary liquidity for employees. Data highlights benefits and typical structures of programs for executive team and board of directors.

NPM benchmark data enables company to strategically plan a tender offer following their primary round.

Company Planning First Program

A company is planning to structure its first employee liquidity program and is looking for data on the competitive environment and typical tender designs.

NPM benchmark data helps enable the company to engage employees and aim to achieve an optimal subscription rate.

Company Planning Repeat Program

A company that has previously run tender offer programs and is looking to evaluate current market conditions and competitive environment for similar companies.

NPM benchmark data enables company to attract third-party investors and optimize participation from existing employee pool.

Actionable Data to Optimize Your Tender Program

Request Benchmarks eastCompany Data

- Tender Frequency

- Years in Business

- Sector

- Financing + Valuation

Pre-Program Data

- Timing + Structure

- Offering Size

- Pricing + Eligibility

- Sellable Limits

Post-Program Data

- Transaction Size

- Subscription + Participation

- Purchaser Allocation

- Fee Structure

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of Jan 2025

Access Institutional-Grade Metrics + Analytics

Top Referring Law Firms for Private Company Transactions

-

Goodwin

-

Cooley

-

Latham & Watkins

-

Gunderson Dettmer

-

Simpson Thacher

-

Fenwick & West

-

Wilson Sonsini

-

Kirkland & Ellis

-

Caiola & Rose

-

Paul Hastings

- Company Counsel

- Buyer Counsel

Client Industry Breakdown

Information Technology

49%

Information Technology

49%

Financials

19%

Financials

19%

Health Care

9%

Health Care

9%

Consumer Discretionary

9%

Consumer Discretionary

9%

Industrials

7%

Industrials

7%

Communication Services

4%

Communication Services

4%

Consumer Staples

3%

Consumer Staples

3%

Our Recent Client Valuations

- 15% $0-$250M

- 7% $500M-$1B

- 8% $1B-$2B

- 38% $2B-$5B

- 33% $5B+

Global Client + Investment Network

- 🇦🇺 Australia

- 🇧🇲 Bermuda

- 🇧🇷 Brazil

- 🇨🇦 Canada

- 🇰🇾 Cayman Islands

- 🇨🇴 Colombia

- 🇪🇪 Estonia

- 🇫🇮 Finland

- 🇫🇷 France

- 🇩🇪 Germany

- 🇭🇰 Hong Kong

- 🇮🇩 Indonesia

- 🇮🇱 Israel

- 🇯🇵 Japan

- 🇱🇹 Lithuania

- 🇱🇺 Luxembourg

- 🇲🇽 Mexico

- 🇸🇬 Singapore

- 🇨🇭 Switzerland

- 🇸🇪 Sweden

- 🇺🇦 Ukraine

- 🇬🇧 United Kingdom

- 🇺🇸 United States

Data as of Jan 2025