Wealth Connect

Empowering you to make smarter financial decisions.

Connect with top wealth management and tax planning resources for free.

Invest funds from NPM liquidity events to earn interest and find new ways to generate tax savings.

Preserve + Build Your Wealth – Opportunities for Growth

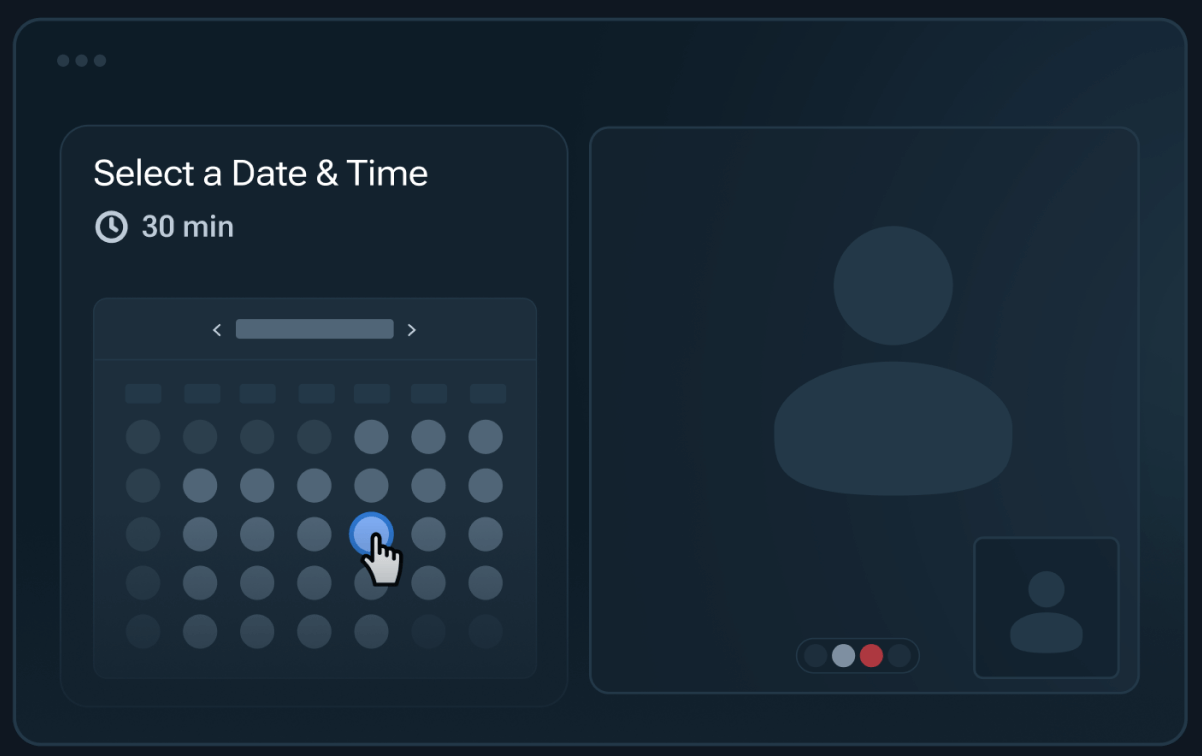

Find a Financial Advisor

Match with independent financial advisors for expert advice.

(Select NPM Clients Eligible)

- Connect with advisors well suited to meet your needs.

- Navigate the complexities of business and personal finances.

- Structure finances to fund life events and plan for wealth transfer.

Set Up a Robo-Advisor Account

Sign up for a robo-advisor or start DIY investing.

(All Shareholders Eligible)

- Low fee, easy to use investment platform.

- Rebalancing, reinvesting and tax-loss harvesting.

- Build a portfolio based on your investment goals.

Open A High-Yield Online Savings Account

Enroll in a premium savings account with competitive APY.

(All Shareholders Eligible)

- No fees. No minimum deposit. FDIC insured.

- Free same-day withdrawals and unlimited transfers.

- Monitor accounts online or in app.

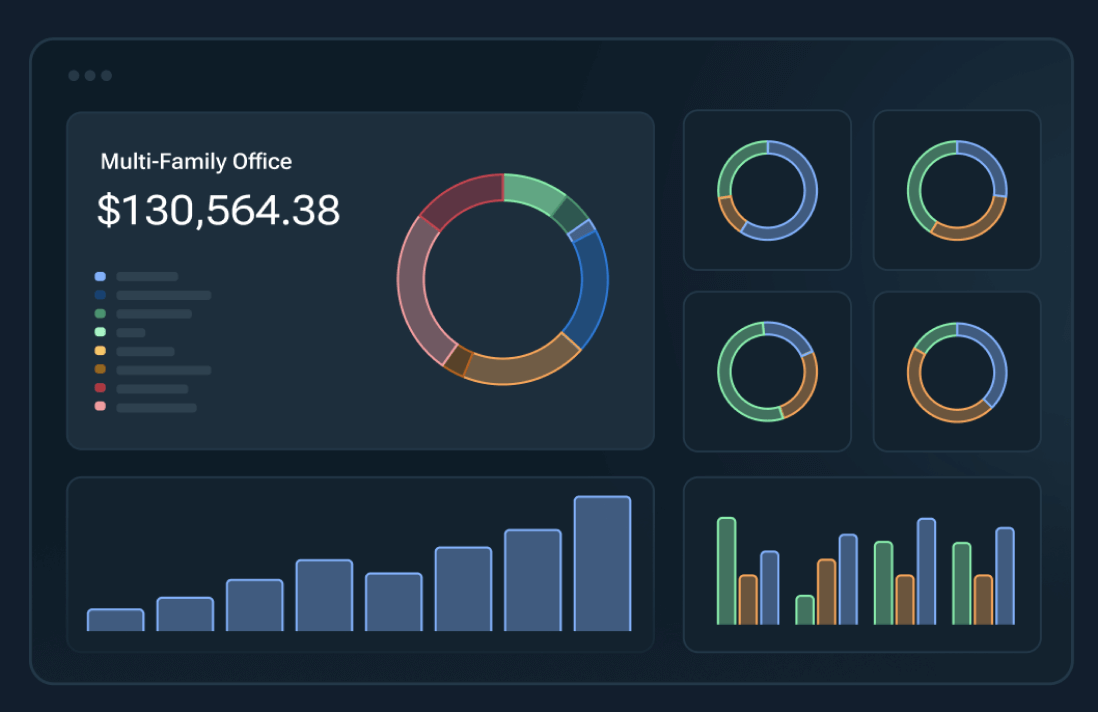

Select a Multi-Family Office

Consult an independent advisory firm to help find, diligence, and compare family office solutions. (Select NPM Clients Eligible)

- Manage family wealth across investments, planning and tax strategy.

- Leverage a team of professionals to tailor your investments.

- Manage equity awards and family governance.

Find a Financial Advisor

Advisors enable you to navigate liquidity events efficiently, offering advice for investments, tax, as well as estate planning. Through a premier wealth management platform, select from hundreds of advisors from independent firms that manage $100B+ AUM to help you achieve your goals.

What to Ask a Financial Advisor

Fees

Always understand the fee structure. Fee-based advisors charge upfront fees but may also earn commissions. Fee-only advisors rely solely on fees – flat rates, hourly rates, or percentage-based on AUM.

Credentials

Ask about their experience, education, and track record. Research their background and request client references. Be wary of advisors who are reluctant to share this information.

Compatibility

Learn about the advisor’s investment philosophy and make sure it aligns with your goals. Always discuss risk preference to agree on an investment strategy.

Investment Services

Confirm advisor specializes in the services you need – investments, retirement planning, estate planning, tax advice and more.

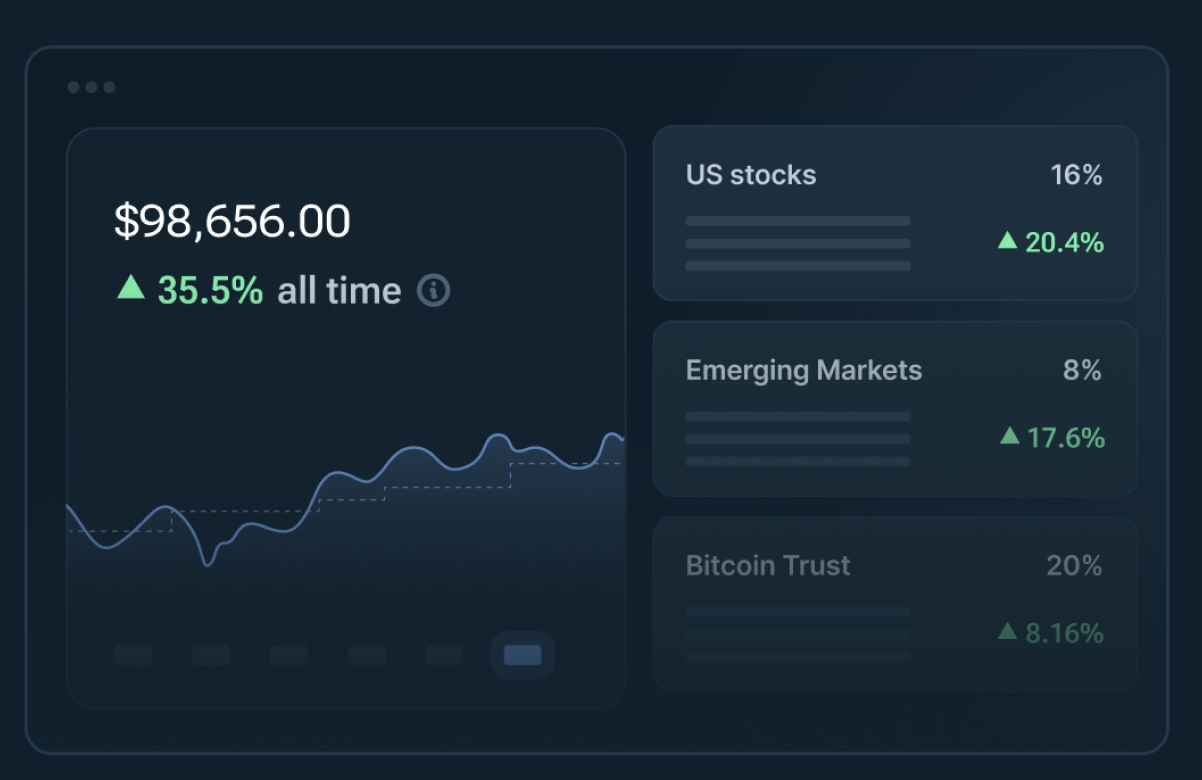

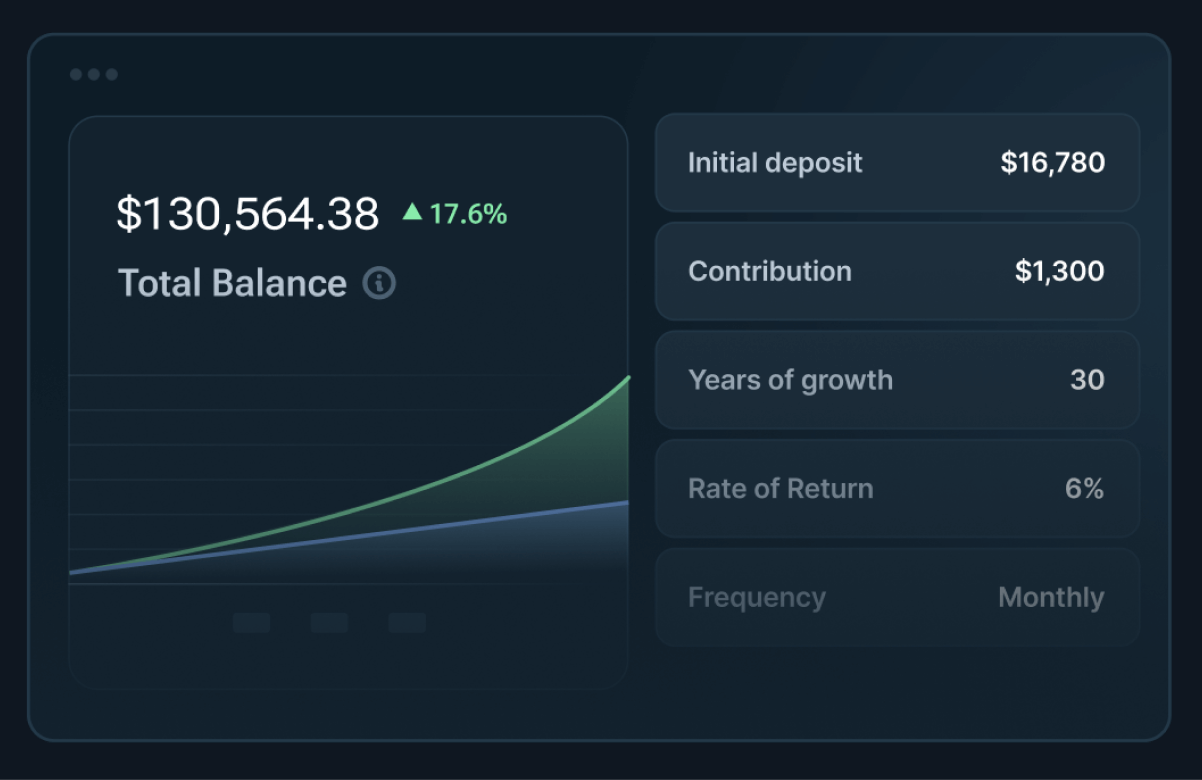

Fund a Robo-Advisor Account Through One of Our Partners

An automated investing account simplifies long-term wealth building by managing risk, maximizing returns, and minimizing taxes, even during market fluctuations. Select your mix of funds, risk profile, and watch your wealth grow.

What to Expect from Your Robo-Advisor Account?

Personalize Your Portfolio

Customize your investments, selecting from funds and asset classes that match financial goals and risk tolerance.

Rebalancing

Automatically rebalance investments, selling ones that rise above your allocation target and buying more that fall below.

Reinvesting

Maximizing performance by reinvesting funds from dividend payments, interest payments and asset sales.

Tax-Loss Harvesting

Platform monitors your investments to offset your capital gains by claiming small losses, which can help lower your tax bill.

Open A High-Yield Online Savings Account Through One of Our Partners

Start earning an annual percentage yield (APY) from day one with no minimum deposit or credit check required. Link your existing checking or savings accounts for seamless same-day transfers. Enjoy unlimited withdrawals and transfers, all managed conveniently through a mobile app.

What Are the Benefits of a High-Yield Online Savings Account?

Savings Goals

Build emergency funds, save for big purchases or earn interest on your retirement funds.

No Fees

Zero fees. Earn interest on your cash without paying fees to park and grow your money.

Easy Investing

Takes just minutes to open an account online, unlimited withdrawals and transfers in and out of your account.

Earn Interest

Leverage a competitive interest rate on your cash and watch your money grow.

Select a Multi-Family Office

Let us connect you with an experienced team to help you find, evaluate, and select the optimal family office structure. Multi-family office advisors serve multiple families with similar needs, delivering personalized advice, including investment management, financial planning and other family office services.

What is the Process for Selecting A Multi-Family Office?

Educate

Learn about the options for selecting a multi-family office. Gain an understanding about what you can expect when going through the process.

Recommend

Get personalized recommendations about which multi-family office could be right for your needs.

Meet

Connect with the firms that best address your specific criteria. Meet teams to compare and contrast different options based on your requirements.

Select

Discuss and evaluate the information that has been shared. Evaluate your shortlist for additional follow up information and then make your selection to move forward.