You Earned Your Equity. Now Unlock Your Wealth.®

Join 150K+ employees who use NPM SecondMarket®.

Sell your shares and discover the value of your equity.

Equitable Platform

Buyers and sellers pay the same fee.

$0 Open an Account

Free and fast to sign up. No commitment required.

Access Share Value

Explore data and pricing on 400+ private companies.

Marketplace

Access a global network of hundreds of buyers and investors.

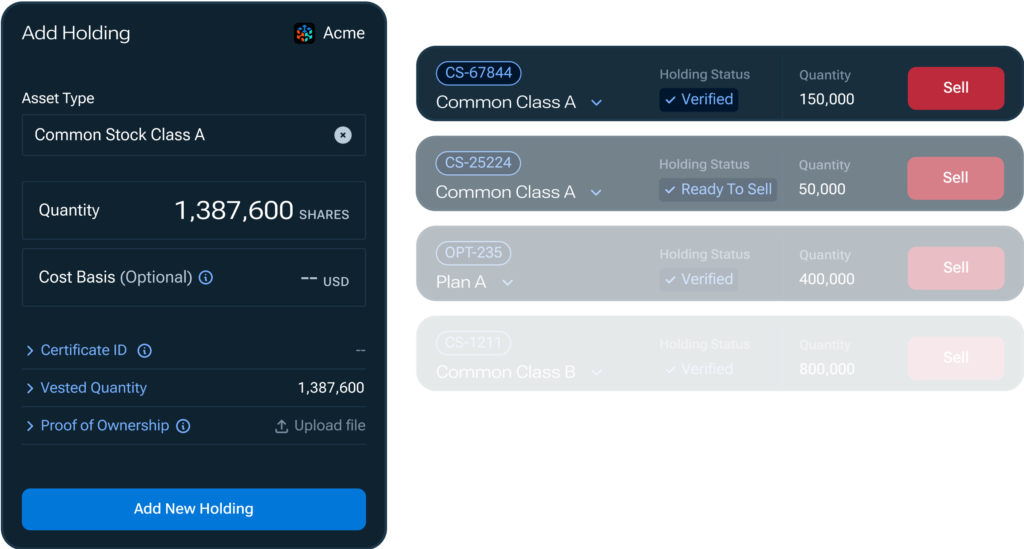

Add Holdings

Add your holdings and determine what your equity shares are worth.

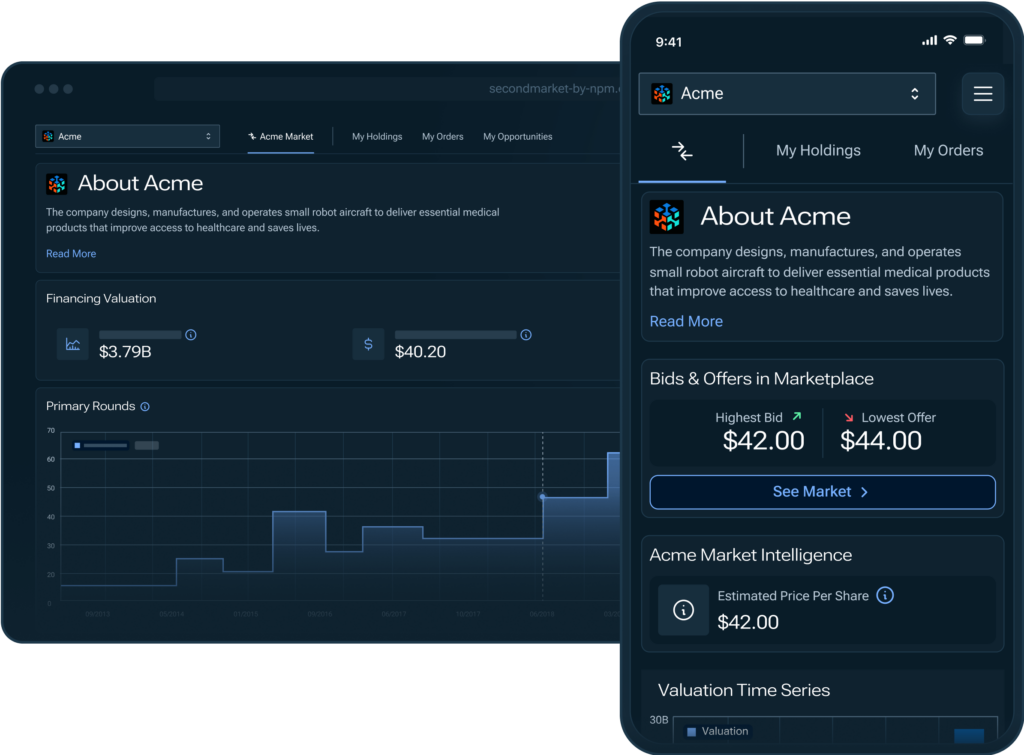

Access Market

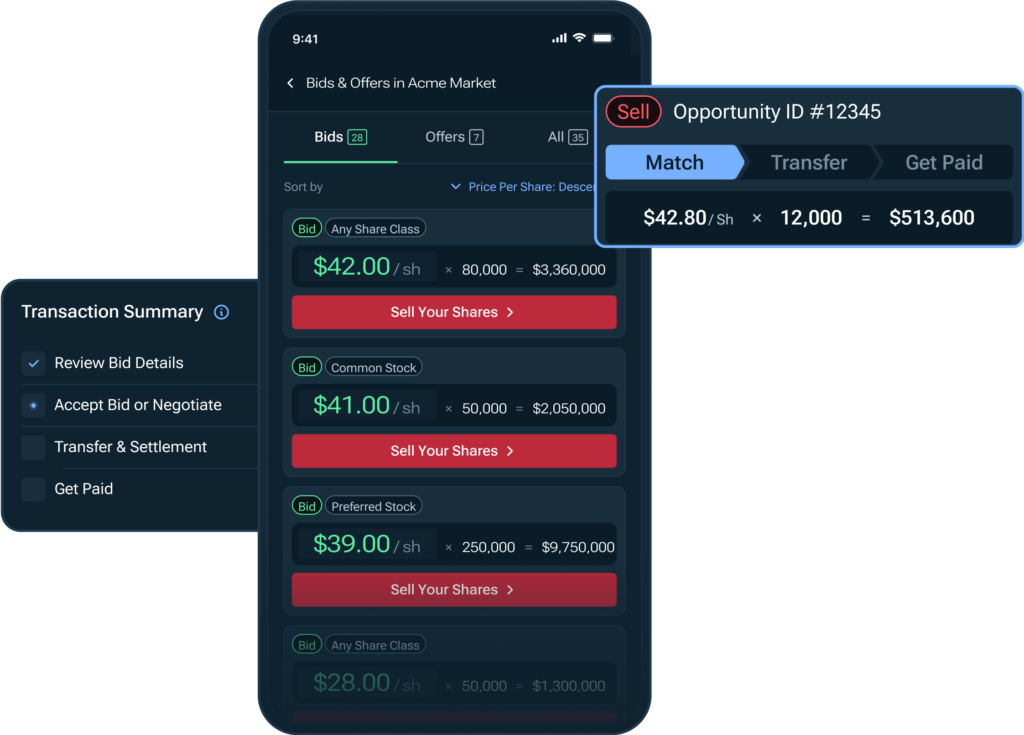

Find active buyers and learn what others like you are selling in the market.

Sell Order

Respond to an existing buy order or submit your own sell order.

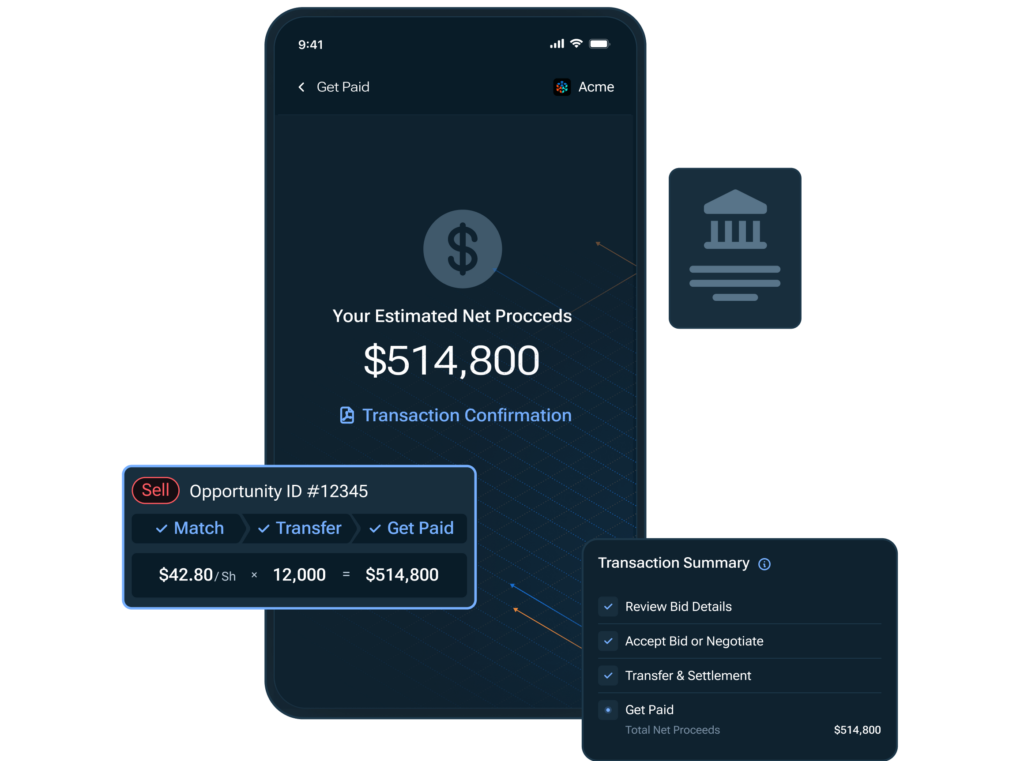

Match + Settle

Match transactions, settle shares, and transfer funds to get paid quickly.

Initiate a Sale to Fund a Life Event.

Add your holdings and determine what your equity is worth and the best path for you.

Private companies are staying private longer, but your needs don’t wait until tomorrow. Sell your shares to buy a new home, fund education, or pay for other expenses.

Find Buyers in Your Company.

Our broad investor network of buyers helps employee shareholders access liquidity when selling shares. See what live buy and sell orders are in the market to determine the best price for you.

Negotiate Your Orders.

Our platform provides sellers with visibility throughout the transaction process and allows you to directly accept or negotiate with live bids or start your own sell order.

Settle Shares + Transfer Funds. All On One Platform.

Our proprietary Transfer and Settlement technology helps manage share transfer activity from match to settlement fast tracking transfer of funds alongside the company equity administration team.

Wealth Connect

After a transaction, connect with a wealth advisor for tax advice and intelligently invest your proceeds.

Find a Financial Advisor

Match with independent financial advisors for expert advice.

(Select NPM Clients Eligible)

- Connect with advisors well suited to meet your needs.

- Navigate the complexities of business and personal finances.

- Structure finances to fund life events and plan for wealth transfer.

Set Up a Robo-Advisor Account

Sign up for a robo-advisor or start DIY investing.

(All Shareholders Eligible)

- Low fee, easy to use investment platform.

- Rebalancing, reinvesting and tax-loss harvesting.

- Build a portfolio based on your investment goals.

Open A High-Yield Online Savings Account

Enroll in a premium savings account with competitive APY.

(All Shareholders Eligible)

- No fees. No minimum deposit. FDIC insured.

- Free same-day withdrawals and unlimited transfers.

- Monitor accounts online or in app.

Select a Multi-Family Office

Consult an independent advisory firm to help find, diligence, and compare family office solutions. (Select NPM Clients Eligible)

- Manage family wealth across investments, planning and tax strategy.

- Leverage a team of professionals to tailor your investments.

- Manage equity awards and family governance.

What is Your Equity Worth?

Sign Up east

Knowledge Center

Demystifying Private Company Share Sales.

Am I allowed to sell my private company shares?

01Yes, selling your private shares is possible depending on the company you are selling the shares in and its policy with respect to employee/ex-employee share sales. Many companies organize structured offerings such as tender offers that allow employees to sell small portions of their vested shares. It is also an increasingly common practice for employees to sell independently of these tender offers to address more urgent financial needs.

What role does NPM play?

02NPM offers a platform to help you determine the market price of your private shares and connect with buyers to sell them to. Upon a successful match, NPM manages the transaction settlement process with the company, buyer, and yourself so you can receive your sale proceeds as well as any tax documentation. NPM draws upon over a decade of experience working with hundreds of private companies and over a hundred thousand individual sellers to ensure a smooth selling experience for you.

How is the sale price determined?

03The sale price is agreed upon mutually between you and the buyer. You can accept a standing bid or negotiate a different price with the buyer behind the bid. Alternatively, you can post a sell order that a buyer on the market may accept or counter. Throughout the process, you will also have access to market data on the given company such as pricing for any recent primary rounds as well as the estimated market price range.

What fees does NPM charge?

04NPM charges a flat 1% commission to an individual seller on any trades that successfully match and settle through our platform. There are no fees to submit an order or to simply open and maintain an account with NPM.

Do I need to exercise my options before selling?

05NPM doesn’t require you to exercise your options before posting a sell order on our platform. However, the options do need to be exercised before any actual share transfer can take place. Several companies allow simultaneous exercise-and-sale giving sellers flexibility to use part of their sale proceeds to cover the exercise cost. You can only sell from your vested options.

How long does the sale process take?

06The end-to-end sale process typically takes 30-45 days (about 1 and a half months), depending on two factors. First, the amount of time it takes to locate a buyer for your shares. This depends on the level of demand in the company you are selling shares in. Second, the company’s own timelines for approving transfers. Once an agreement is reached between you and the buyer on key sale terms, NPM notices the company to start the clock on the approval timeline which is typically 30 days but can be longer depending on the company.

Does the company need to approve the sale?

07Yes, most employee shares are subject to standard transfer restrictions that give the company the discretion to either approve or reject a secondary transfer of shares. The company may also choose to exercise the right of first refusal, which means your stock will be bought by the company or a different buyer selected by the company instead of the buyer you matched with. This results in the same outcome for the seller.

What are the benefits of opening an account with NPM?

08Your NPM account allows you to access our marketplace, connect with buyers, and sell your private shares. In addition, you can monitor the market value of your private shares using our free pricing data.

What is the minimum holding size to open an account?

09There is no minimum holding size to open an account. All transactions need to be greater than $25,000 in notional value.

How do I get started?

10Click here to open an account or chat with us.